It has been a tough ride for the IT sector stocks. The Nifty IT index is down by 16 per cent in the last one year and has underperformed the Nifty 50 by over 20 per cent. The Nifty IT index is also deep in bear market territory now, having fallen 27 per cent from its all time high levels reached in January. The correction in the sector has been driven by three factors – one, valuations running far ahead of fundamentals; two, margin pressures driven by supply side constraints/high attrition; and three, demand side concerns as recession threat looms over developed economies.

While at BL Portfolio we had been getting cautious on the sector since mid-2021, steep correction in the sector is gradually creating pockets of opportunity for long term investors. One such stock is Zensar Technologies (Zensar) which investors can consider adding to their portfolio now. After a correction of 60 per cent from its peak, the stock offers sufficient margin of safety for headwinds the industry/company face. Trading at one year forward PE of just 13.5 times, EV/FCF of 12.5 times, and net cash in the balance sheet at around 25 per cent of current market cap, the risk-reward is getting favourable for the stock. While headwinds from further margin pressure and potential impact to business from slowdown in developed markets remain, if one has a multi-year perspective, buying at current levels may pay off well.

Historically, for well-established IT companies in India, strong net cash balance has provided support and when it has reached levels of 20-30 per cent of market cap, and valuations are cheap, many a times stock returns have played out well in the long term. Few examples where it played out well are Hexaware and Polaris Financial Technologies, in the previous decade. This apart, high net cash/market cap has also proven to be decent supports for many other Tier 1 & 2 IT services companies over the last two decades during challenging times. Investors however need to note that patience will be required, as catalysts in terms of value unlocking via utilisation of excess cash or tiding through current business headwinds will be required for realising value in stock. The timing of both cannot be predicted.

Business and performance

Pune headquartered Zensar is a well established mid-tier IT services company and part of the $4 billion RPG Enterprises Group. Its operations are spread across geographies with over 30 locations worldwide. It derives revenue from six internally demarcated verticals; Hi-Tech (27.4 per cent of revenue), Consumer Services (18.8 per cent), Banking (16.7 per cent), Insurance (16.5 per cent), Manufacturing (13.2 per cent) and Emerging (7.5 per cent). In terms of geographic revenues, it derives 71 per cent from North America, 18 per cent from Europe and 11 per cent from Africa.

Similar to peers Zensar too benefited from the pandemic induced digital thrust and saw significant uptick in business momentum. This combined with investor excitement over tech stocks, resulted in Zensar stock zooming 8x from its covid lows of March 2020. However since peak levels reached in September 2021, the stock has been on a decline driven by broader market pressures/headwinds and few company specific issues.

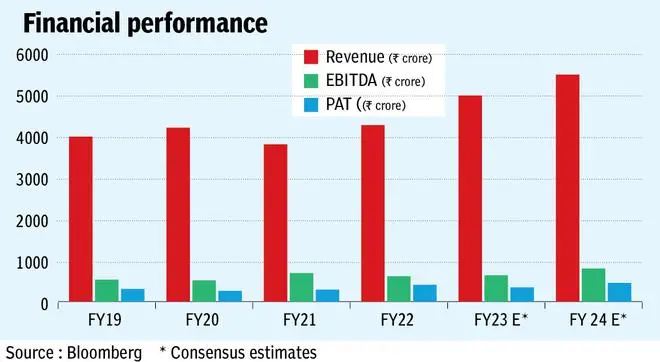

In Q1 FY23, company reported solid Y-o-Y constant currency revenue growth of 26.3 per cent. This was much better than that reported by Tier 1 peers, and somewhat lower than that reported by some of the Tier 2 peers. While revenue growth was good, two factors are a cause for near term concern. First one is on the margin contraction. Company’s EBITDA margins declined to 11.2 per cent for the quarter versus 18.5 per cent reported in Q1 FY22 and 14.1 per cent reported in Q4 FY22. While margins have been on a declining trend across the industry driven by higher wage costs, attrition and reversal of the pandemic related savings (travel, sales and promotion), the contraction was bit steeper for Zensar and performance was much lower than market/analyst expectations.

Almost the entire compression in margins on sequential basis this time was driven by higher cost of delivery (primarily salaries and subcontracting costs) which increased by 10 per cent sequentially, and lower utilisation. On a Y-o-Y basis, cost of delivery increased by 41 per cent and outpaced revenue growth by far. Overall while revenue in rupee terms increased by 29 per cent, net profits declined by 26 per cent. Management has now pushed back its targets of achieving mid teens EBITDA margins to Q2 of FY24, versus earlier target of achieving it in FY23.

The second factor that caused concern from recent results is that, while most verticals reported robust growth, management indicated seeing impact in its Hi-tech and Consumer services verticals due to impact of weakening macro economic conditions globally. While this ideally must not be a surprise given the slowing global growth, the concern stems from the fact that Zensar appears to be seeing this trend earlier than most of its peers whose results have not indicated any impact of slowdown as yet.

Post Q1 results, analysts (Bloomberg consensus) now estimate EPS for Zensar to decline by 14.5 per cent in FY23 and rebound by 30.5 per cent in FY24.

Why buy despite headwinds?

There are three reasons why investors can consider buying the shares despite the current headwinds. The first being the case that margin pressures are expected to alleviate over the next few quarters as companies across the industry including Zensar improve utilization, increase deployment of freshers, negotiate better billing terms etc. The second reason is that the current global enterprise tech cycle with focus on digital transformation is expected to have a longer life although there may be impact in the interim as developed economies tide through current macro economic issues. The third reason is that historically many a times well established companies in the IT sector have created market beating wealth for investors from the levels at which Zensar is trading now in terms of earnings multiples and net cash as percentage of market cap. The company is free cash flow positive (FY23 FCF yield at 6 per cent) and cash balance is only likely to keep strengthening (unless company engages in any M&A). While there is no certainty that Zensar to will give returns like some of its peers in the past, the risk is worth taking.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.