About a year since its IPO, the small-cap SJS Enterprises trades 19 per cent below its IPO price. At that time, the stock was a bit pricey, valued at about 34 times FY21 earnings. With prospects remaining rosy, valuations are more attractive currently. At ₹440 now, the stock trades at 24.3 times FY22 earnings and 18.7 times its expected earnings for FY23 (based on growth expectations spelt out by the company). There are no listed peers for SJS.

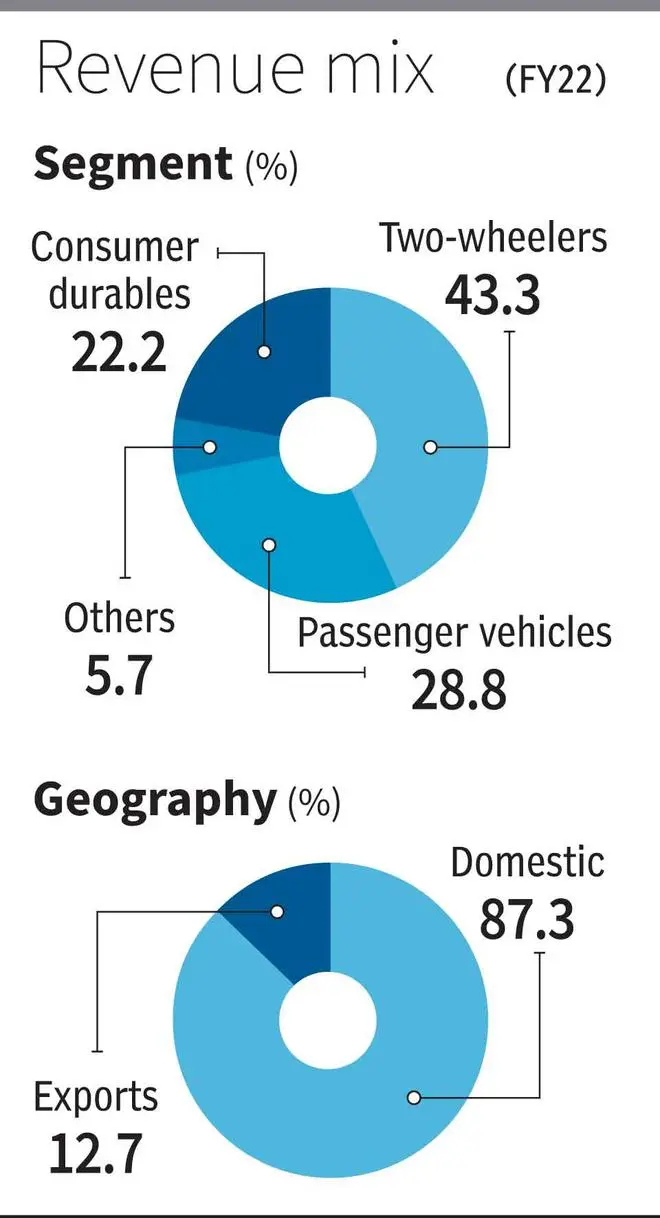

SJS is a play on the cyclical upturn in the domestic auto industry, being a supplier of products such as logos, decals (stickers) and overlays as well as advanced technology products such as 3D dials/logos, optical plastics, and injection moulded parts. A little more than a fifth of the revenues come from the consumer durables segment. Diversified clientele, efforts to add to the product line and premiumise the offerings, high margins of about 25 per cent as well as net debt-free nature of the company are positives. Investors with a long-term perspective can buy the stock but restrict your investments, given the small-cap nature of the company (market cap of ₹1,340 crore approximately).

The tailwinds

Despite challenges such as high input prices, rising interest rates and chip/semiconductor shortages, domestic auto sales have done well in the first half of this fiscal. Overall vehicle sales volumes have grown by 32 per cent year-on-year in April-September 2022, compared with the 6 per cent fall in FY22 over FY21. Significantly, two-wheeler sales volume growth has come in at 28 per cent in the first six months of this fiscal, as against a fall of 11 per cent in FY22. Two-wheelers is a key user segment for SJS, bringing in 40-45 per cent of the revenues, followed by cars. While key customers include Royal Enfield, TVS, Bajaj Auto, Suzuki, Visteon, Whirlpool, Samsung and Godrej, the company has won fresh orders domestically from Mahindra, TVS, Bajaj, Samsung, Honda, Hyundai, MG and Maruti Suzuki in recent times.

Secondly, expansion in offerings as well as value additions to the product portfolio stands the company in good stead, enabling cross-selling opportunities as well as helping profit margins. Relatively new premium products such as In-mould decorations (IMD) and lens mask assemblies contributed around 16 per cent to the revenues in FY22, compared with just 3 per cent in FY19. The continuing trend of premiumisation — be it the preference for higher cc bikes or SUVs — is a tailwind for SJS, as these demand higher aesthetics. Over the next two-three years, the company is looking to introduce other value-added products such as illuminated logos as well as in moulded electronic parts. Premium products also bring in better margins.

The company acquired Exotech in April 2021, adding chrome plating capabilities to its kitty. While chrome plated products bring in lower margins than SJS’s other offerings, the company has been able to improve it by 150 basis points in the first year of acquisition (FY22), thanks to cost efficiencies. Going ahead, the company expects 13-15 per cent margins to be sustainable for chrome plating. It is currently at 12.4 per cent.

What will help the margin expansion to an extent is also the export opportunity for this product (typically export margins tend to be higher). According to the company, chrome plating business is seeing good traction in the export market. For instance, the company has successfully been able to cross-sell chrome plated badges to its existing export customer, Whirlpool. SJS is looking to grow this chrome plating business from ₹130 crore revenues per year currently to ₹300 crore, entailing capex of about ₹100 crore over the next two years to set up additional production facilities. Exports currently bring less than 15 per cent of the revenues and the company added Alladio, an appliance maker based in Argentina as well as Stellantis, recently, to its clientele. While globally, aesthetics suppliers are no doubt fragmented, cost competitiveness vs developed markets as well as China+1 strategy is drawing OEMs towards India and SJS is a beneficiary.

Financials

In the quarter ended June 2022, revenues (consolidated, including Exotech) grew 39 per cent year-on-year to ₹103 crore and consolidated profits, by 70 per cent to ₹16.2 crore. The strong growth could have partly been aided by the low base in the June 2021 quarter (Covid second wave). EBITDA margins stood at 26.4 per cent vs. 24. 7 per cent a year ago. Given the upturn in the auto cycle, the client additions and the new order wins, SJS expects revenues to grow by 25 per cent y-o-y in FY23, and profits by, 30 per cent. As of FY22, the company had free cash flow of ₹50 crore and net debt to equity of minus 0.25 .

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.