Investors with a two-to-three-year investment horizon can consider investment in the stock of India’s leading defence shipbuilding company, Mazagon Dock Shipyard. The company is the only shipyard company in the country to build conventional submarines and destroyers.

With a niche product portfolio and a robust order book of over ₹42,000 crore, the defence PSU’s revenue is expected to grow at an annualised 25 per cent over the next two years. At the current price of ₹722.8, the stock trades at about 13.3 times and 11.4 times its estimated FY23 and FY24 earnings. We believe the stock to be a good diversification idea for investors with a moderate risk appetite for three reasons.

Positive aspects

First, the company is a pioneer in conventional submarines and destroyers and has built a total of 799 vessels since 1960, which features 26 warships including advanced destroyers, missile boats as well as six submarines. Besides naval platforms, the company also builds merchant ships such as passenger-cum-cargo vessels, dredgers, tankers and other specialised products for oil and gas industry, for instance, jack-up rigs and offshore platforms. In November 2022, Mazagon delivered its second missile destroyer and the same was commissioned in December 2022. It also delivered its 5th Scorpene submarine in December 2022, which was commissioned in January 2023.

The company is expecting an additional order of ₹33,000 crore over the next two years, according to news reports, which includes eight next-generation corvettes and six high-speed landing crafts. The order from Navy is expected to remain strong over the next few years, with the total requirement almost being close to a lakh crore, of which Mazagon can get a sizeable portion, in terms of orders. The company, as of September end, had orders worth ₹42,000 crore, likely to be executed over the next three years, which will drive healthy growth in revenue.

Besides, Mazagon has three projects ongoing with IIT Madras for developing three Artificial intelligence-based products. These should help in neural network training and improve efficiency and reliability by eliminating human errors. These products, whenever commercialised, can be revenue-accretive and also help improvement in profitability.

Our second reason for optimism is that the company, in 2018, completed modernisation of its facility at a cost of ₹900 crore. The benefit from this exercise will be two-fold. One, the capacity for warships has increased from 8 to 10. Likewise, submarine capacity has increased from 6 to 11. With the investment, the company has enabled integrated modular construction of warships, and shift from unit assembly to block assembly, which will help reduce the construction period. This will enable faster translation of orders into sales.

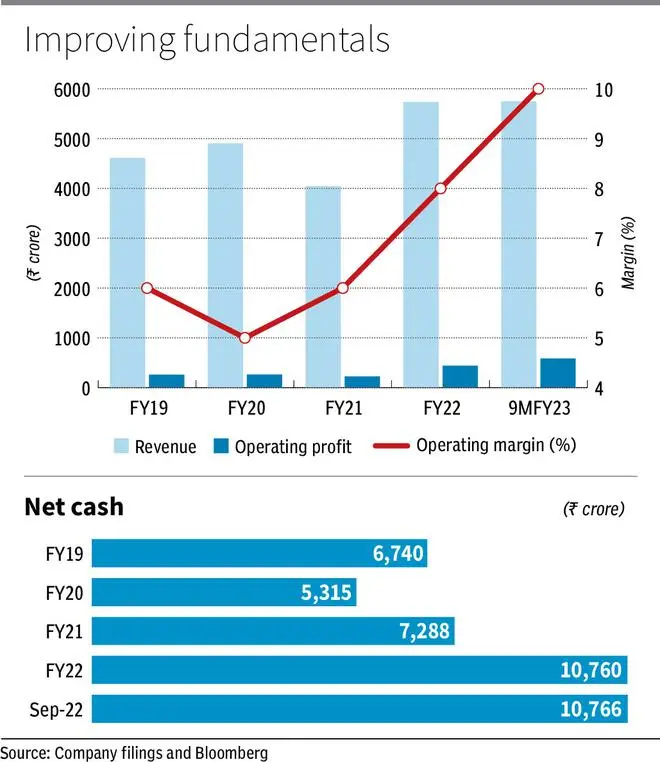

Further, the company has successfully indigenised sourcing/manufacturing of select critical components used for both submarines and warships. This will reduce costs and import dependency. The impact of these initiatives is visible in the company’s operating profit margins over the last five years, which has doubled from about 5.3 per cent in FY20 to over 10 per cent in the nine-month period ended December 2022. Going forward, the operating profit margin should continue to improve and sustain at healthy levels.

Third, the company’s strong balance sheet, given that it is debt free and has cash in bank of ₹10,766 crore, adds to the attractiveness of the business. In the current scenario of high interest rates, Mazagon is among the few companies with rich cash reserves, which fetches interest income equivalent to almost 80 per cent of its operating profit. That is, during April-December 2022, s operating profit was ₹587 crore, while other income stood at ₹481 crore.

In the nine-month period ended December 2022, the company reported revenue growth of 33 per cent to ₹5,749 crore, compared to ₹4,337 crore in the same period last year. Operating profit margin improved from 8.2 per cent to 10.2 per cent for the same period. Net profit, however, grew at a faster pace of 71 per cent, thanks to the higher other income/investment income, to ₹754 crore during April-December 2022 compared to ₹442 crore during April-December 2021.

Going forward, revenue is expected to grow at 25 per cent annually over the next two years, on the back of strong order book position. Assuming a marginal improvement in operating profit margin to 12 per cent (and flat other income), earnings should grow at a 17 per cent compounded rate over the next two years. This makes the stock attractive from a one-year and two-year forward earnings multiple basis.

While the company’s strong order book and improving margins reinforce its technical prowess built over a period of time, the only risk to estimates may be on account of delays in execution of these projects.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.