Investors with a long-term perspective can consider buying the stock of H.G. Infra Engineering. The company has a well-established presence in road sector and has a track record of over 19 years of execution in this space. The stock is trading at a one-year forward PE of 8.7 times (Bloomberg consensus) and at a discount to its two-year average of 9.8 times. The company’s strong order book, decent execution capabilities, and consistent and growing profitability make it an interesting bet at current levels. However, given broader market volatility due to global slowdown and interest rate hiking cycle in play, investors can look to accumulate the stock over the next few months rather than buying at one go.

Business prospects

H.G. Infra Engineering initially started off as a focused EPC (Engineering, Procurement and Commissioning) player. Today, with NHAI awarding considerable HAM projects, EPC now represents 64 per cent of its order book and remaining 36 per cent comes from HAM (Hybrid Annuity Model). HAM is a mix of EPC and BOT (Build operate and Transfer). This is a PPP model where the private contractor and the government partner to execute the project. In this model government fronts 40 per cent of the cost and the private contractor has to arrange the remaining 60 per cent of capital. Once the project is completed, the government starts paying annuity to the contractor over a period.

The company has 58 per cent of its projects from Government agencies while remaining 42 per cent comes from private entities. Geographically the company has its projects in 9 States, with major concentration in Uttar Pradesh, Odisha, and Telangana. One of the major ongoing projects of the company is Karala-Kanjhawala for which 14 per cent work is completed and unexecuted work worth ₹1,070 crore is left. Another major project of the company is Raipur-Visakhapatnam OD5 which is 5 per cent complete and ₹1,217.7 crore worth of unexecuted work is left. Recently, the company received certificate of completion for the Ateli-Narnaul Highway (₹952-crore project). The project was completed 255 days earlier and therefore eligible for bonus

The order book of the company currently stands at ₹11,507.7 crore (87 per cent higher than June 2021 order book of ₹6,143.8 crore). Its order book gives a good revenue visibility of around 3 years based on FY22 revenue. The company has also given order inflow guidance for FY23 at ₹9,000-₹10,000 crore. It has got an EPC contract from Adani (Ganga expressway) worth ₹4,971 crore. Another ₹3,500 crore is expected to come from HAM projects while ₹1,000-₹1,500 crore can come from NHAI EPC, Jal Jeevan Mission and Railways.

Recent financials

The company reported a revenue of ₹1,105.9 crore in June 2022 quarter, a 17.2 per cent growth over June 2021 quarter. The EBITDA for June 2022 was ₹199 crore, which is a 11.9 per cent growth over June 2021, which was at ₹177.8 crore. In June 2022, PAT was reported at ₹1,09.4 crore - a growth of 8.3 per cent over June 2021 which was at ₹1,01 crore. . The company has given revenue guidance of ₹5,000 crore with EBITDA margins guidance at 15.5 per cent to 16 per cent for FY23.

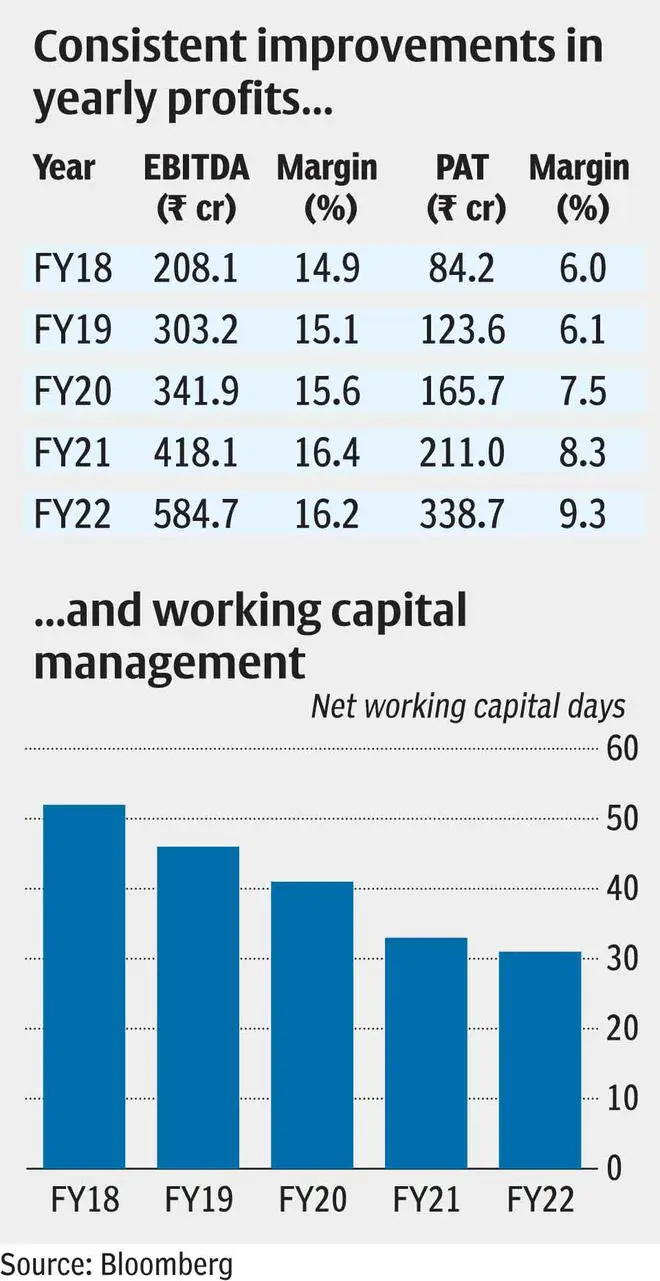

The company has shown consistent and impressive performance on the profitability front. From FY18 to FY22 it reported an EBITDA CAGR of 29 per cent while the PAT (Profit after tax) CAGR has been 42 per cent from.

The company has seen a rise in the standalone debt levels in June 2022 quarter over March 2022 quarter by around ₹133 crore to ₹4,47.5 crore and around ₹223-crore rise in consolidated debt levels, which is at ₹1,406.1 crore. According to the management, this rise is an interim one mainly because the company has got appointed dates for 3 HAM projects and the investment in them was made. In addition, the debtors have also gone up in the SPVs.

According to the management, the payments from debtors have started flowing in Q2 and therefore the debt levels are expected to cool to ₹300-₹350 crore in the current quarter itself (standalone). The Net Debt/EBITDA as on June 30, 2022, is 1.94, which implies a reasonably comfortable leverage position for the company.

The company requires ₹1,137 crore to fund the equity portion of its HAM projects out of which ₹529 crore has been invested in June 2022 quarter alone and looking to raise ₹286 crore in the rest of the year and balance in FY24 and FY25. To take care of the funding the company needs to have a good monetisation programme as the typical awarding of NHAI seems to be HAM now. The company is in discussions with potential funds for the monetisation of four of its HAM projects.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.