The government’s ambitious target of increasing India’s renewable power generation capacity to 500 GW by 2030 will have to be backed by the expansion and upgradation of the nation’s existing power transmission infrastructure. The government has planned a capex of ₹3-lakh crore to be spent on India’s power transmission system. The biggest player in the space is Power Grid Corporation of India. The company has near monopoly in the inter-State transmission system of India with 1,72,437 circuit km and 265 substations, and remains well-positioned to capitalise on the long-term opportunities in the sector.

From its all-time high of ₹248, the stock has seen a correction of around 15 per cent. Currently, the stock trades at a P/E of 8.5 times, lower than its three-year average P/E of 9.7 times. In the current scenario of market volatility, long-term investors can accumulate the shares of Power Grid Corporation of India owing to its reasonable valuation,, stable project pipeline, assured returns through regulated projects and strong dividend yield.

Business

Power Grid Corporation of India handles about 50 per cent of India’s total power transmission. For FY22, the company has generated about 96 per cent of its revenue from the transmission business, while other sources of revenue have been telecom (2 per cent) and consultancy (2 per cent). A majority of the company’s transmission revenue comes from the regulated tariffs set by the Central Electricity Regulatory Commission (CERC) which ensures complete pass-through of costs plus 15.5 per cent of pre-tax ROE (Return on Equity) on its completed projects awarded under the regulated tariff mechanism.

Along with this, the company earns revenue under TBCB (tariff-based competitive bidding), where it competes with private players such as Adani Transmission and Sterlite Transmission. Here, projects are awarded to the company providing cheapest bids and tariffs are competitive. However, despite the competition, the company has been able maintain its foothold in TBCB with ₹14,800-crore worth of work-in-hand TBCB projects. Also, recently, the firm was declared the successful bidder under TBCB for establishing two 400kV DIC Transmission lines passing through Rajasthan and Madhya Pradesh.

The company monetises many of its assets by transferring them into InvIT (infrastructure investment trust) set up in 2021, wherein the company holds more than 25-per cent ownership being its sponsor. Currently, the company has been transferring some of its TBCB assets only.

On account of India already being transited into single grid, further opportunities in the inter-State transmission space seems to be lesser. The trend of slowing capex can continue for a while; as for FY23, the management expects capex to be ₹8,000 crore as compared to ₹9,600 crore in FY22. Further, the company is foraying into the distribution segment with a potential opportunity of 25-crore smart meters (estimated market opportunity ₹1.5-lakh crore) and BESS - battery energy storage systems (1 GWH capacity completed in Leh-Kaithal project).

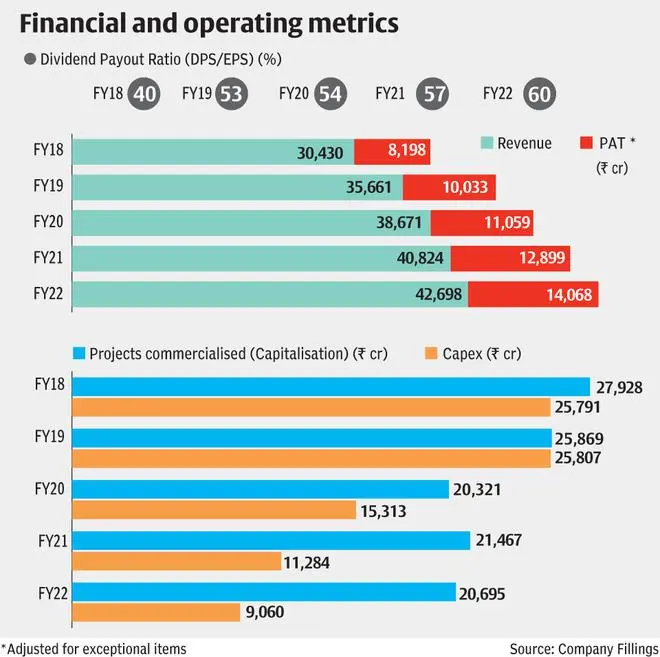

One of the key metrics for investors to track with regard to business is the trends in capex and capitalisation. Capex refers to investments in projects that are yet to be commercialised. Capitalisation of assets refers to commercialisation of projects once the capex has been completed. Capitalisation occurs when the projects which were part of capex earlier have started contributing to the firm’s top line.

Financials

The company saw revenue growth of about 5 per cent for FY22 compared to the previous year on a consolidated basis. Revenue, while stable, has been low in recent years owing to slow pace of capacity addition and project completion which can be reflected through drop of 4 per cent year-on-year and 20 per cent year-on-year for FY2022 in capitalisation and capex respectively. EBITDA has seen an increase of 7.6 per cent over last year, while margins have remained stable at 87 per cent. PAT for FY22 has seen an increase of 42 per cent compared to previous year but such rise has mainly on account of exceptional items.

In terms of leverage, the firm has debt-to-equity (D/E) ratio of around 1.8 times which is reasonable for such high capital-intensive business. Its D/E has been consistently reducing since the level of 2.27 in 2018. Owing to strong earnings visibility, the firm has been able to raise low-cost debt.

For FY22, the company has given dividends of ₹14.75. Excluding special dividends, it was at ₹11.75 . This implies an attractive dividend yield of 5.6 per cent, while if special dividends are also considered, dividend yield is 7 per cent with payout of close to 60 per cent. The dividend payout has been on a rise consistently over the last five years, and the trend can continue in the near future due to asset sell-down into InvIT and strong free cash flow accretion on account of slowing capex.

Key risks

After the completion of One Nation One Grid One Frequency mission — interconnectivity of regional grids, capex opportunities for Power Grid Corporation are limited, which can lead to muted near-term revenue growth. Further, the Power Ministry aims to increasingly adopt TBCB method for new projects where transmission tariff shall be lower to the tune of around 30 per cent compared to the regulated tariff mechanism.

However, despite the near-term slowdown, opportunities to ride the capex wave in the transmission space will likely re-emerge, helping topline growth to regain momentum when renewable power generation picks up pace. Hence investors can accumulate the Power Grid stock on account of defensive characteristics, stable financials and earnings visibility, attractive dividend yield, and reasonable valuation.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.