During times of uncertainty as we are in now, companies with a well-established track record of execution and consistent growth, strong balance sheet and quality management are relatively safer bets. While many companies in the Indian IT sector meet these requirements, from a long-term investing perspective many of them are also trading significantly above their fundamental value and historical valuation range. Entering such stocks offers very little margin of safety for risks that may play out. However, amongst the few where valuations are not out of comfort zone yet is Tech Mahindra (TechM).

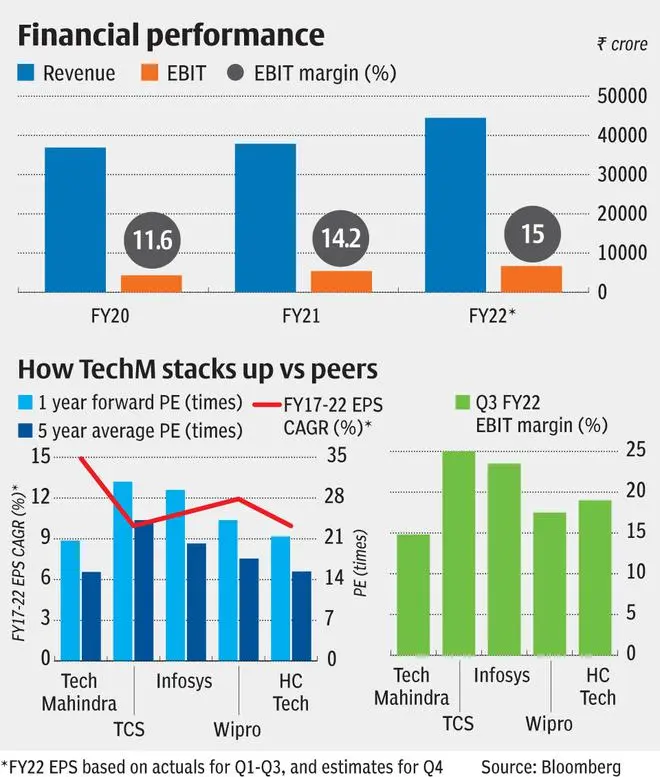

Trading at 20.7 times one year forward EPS (FY23, Bloomberg consensus), TechM's valuation appears reasonable given its good track record of past performance, and decent growth prospects given it is well positioned to capitalise on the long-term digital opportunity. While its current valuation is 35 per cent more expensive than its five-year average, re-rating can be justified as the company traded at discounted valuation in the past versus Tier-1 IT Services peers (TCS, Infosys, Wipro, HCL Tech) when the company’s track record, size and scale was on par with its Tier-1 peers. The company’s lower BFSI exposure, which is a big driver of IT spending, EBIT margins that were lower than peers may have been among the few reasons for its discounted valuation. However, the company has been improving its margin trajectory in recent years. In our Big Story edition dated April 25, 2021, we had recommended a buy on TechM as one of the stocks to ride out the market volatility that was playing out then. Since then, the stock has given returns of 57 per cent outperforming all the Tier 1 peers (TCS 18 per cent, Infosys 39 per cent, Wipro and HCL Tech 25 per cent each).

Given its current valuation and growth prospects, the TechM stock can continue to outperform peers and can be added to one’s portfolio. Due to prevalent global macro and geopolitical risks, we now recommend that investors accumulate on dips of 10 per cent or more from current levels as and when the opportunity presents itself. With the US and the rest of the world expected to grow slower than what was estimated at the start of the year, the earnings estimates of IT services companies, which are significantly levered to global economy, may see some downward revisions. Rupee depreciation versus dollar and euro can, however, provide some offset to this. For example in its monetary policy update last week, the US Fed had lowered US GDP growth outlook for 2022 to 2.8 per cent from the prior estimate of 4 per cent. These headwinds can result in high levels of market volatility and stock price corrections and thus accumulating at lower levels will offer better margin of safety for long-term investors.

Business and prospects

Originally focussed predominantly on telecom vertical, TechM broadened its business exposure post merger of Mahindra Satyam (erstwhile Satyam Computers) with itself in 2013. In terms of verticals, the company derives 41 per cent of revenues from communications, media and entertainment segment; 16 per cent from manufacturing; 8 per cent from technology; 15 per cent from BFSI; 9 per cent from retail, transport & logistics; and 11 per cent from others.

As one of the leading players in IT services when it comes to communications, it has a long history of strong partnerships with leading telecom players. All Tier-1 communication service providers in all continents are its clients. Increasing traction of 5G globally would be a structural positive for the company over the next few years as communication services providers increase budgets for network modernisation and digital transformation. Further, as 5G use cases develop on a large scale over the next few years, the company will be well positioned to capitalise on the opportunity given its competency in communications / connectivity vertical.

As compared to peers such as TCS, Infosys and Wipro which derive more than 30 per cent of revenue from BFSI vertical, TechM’s lower exposure to BFSI and higher exposure to communications, imply the quarterly or annual growth trajectory may differ sometimes. To this extent, there have been times in the past when companies with higher BFSI exposure have outperformed TechM. At the same time, the company has been making investments and acquisitions to ramp up its BFSI exposure.

M&A has been integral to company’s growth strategy to strengthen vertical and digital capabilities. It has however broadly focussed on small tuck-in acquisitions involving limited capital. For example in last 6 months company has made around six small acquisitions - two of them very small, and other four in the range of $60 million to 350 million. While even the largest acquisition of Com Tec Co (a digital engineering company in the BFSI space), at at $350 million is less than 2 per cent of TechM’s market cap and hence small in relation to its size. Such acquisitions help build capabilities and improve client mining.

According to a company presentation, revenues that are categorised as digital represent more than 50 per cent of revenues, which appears on par with Tier-1 peers.

In terms of geographic exposure, the company derives 49 per cent of revenues from Americas, 25 per cent from Europe and 26 per cent from rest of the world.

Financials

TechM reported revenue of ₹11,450.8 crore, EBIT of ₹1,696.9 crore and EPS of ₹15.58 in December 2021 quarter. On Y-o-Y basis, the numbers were up by 18.7 per cent, 10.5 per cent and 4 per cent respectively. When compared with consensus expectations, it was a beat on revenues, but a miss on margins/EBIT/EPS. The margins were impacted by supply side challenges – higher subcontracting and employee costs. This, however, is expected to get addressed and improve going forward with hiring of freshers, increased workforce utilisation and reduced subcontracting costs. Tech Mahindra may also have some pricing leverage to improve margins.

The stock has corrected by around by around 16 per cent YTD, some of which can be attributed to the margin miss in the December quarter. The company on its part however remains focussed on improving margins and intends to build on progress made in recent years. Its constant currency revenue growth is solid and at the top end of the range when it compared with the top IT services companies. Rerating may happen when the company demonstrates further traction in margin improvement.

Incremental positives for the stock that offer cushion against uncertainties are its strong balance sheet with over 5 per cent of market cap in net cash, and FY23 free cash flow yield expected at around 4 per cent. The company distributed dividends of ₹45/share in FY21, which implies a dividend yield of 3 per cent based on its current share price. Good balance sheet and sustainable cash flows can support improving capital returns.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.