In the current context of government’s initiative to achieve 500 GW of installed capacity from non-fossil fuel sources by 2030, hydro power — on account of its ability to ramp up/down quickly — assumes great importance in providing stability to the grid amid intermittent availability of solar and wind.

This, along with the estimated untapped hydro potential of nearly 100 GW, puts NHPC in a favourable position. The company’s stock rose about 28 per cent during 2022 and is currently trading near its all-time high. NHPC is set to benefit from government initiatives towards hydro power sector — such as declaring large hydro power as renewable energy source, and its support towards storage hydel projects and enabling construction of roads and bridges besides dams.

The company is trading at a one-year forward P/E of about 10 times. Investors can look to accumulate the stock of NHPC at dips in view of its growth prospects, favourable government policies and its defensive characteristics such as earnings visibility, strong balance sheet and healthy dividend payouts.

Business

Conferred with the status of Miniratna, NHPC is India’s largest hydro power generator with 15 per cent share of the country’s installed hydro-electric capacity. The PSU has an installed capacity of around 7,017 MW (including storage-based 2,174 MW), of which 98 per cent is hydro-based. It earns majority of its revenue by selling power to state distribution utilities (mainly in northern and north-eastern India) through long-term PPA (power purchase agreement while the rest is through power trading, contracts, project management and consultancy segments.

The tariff that the company earns on its PPAs is cost-plus nature based on CERC regulations. Here, subject to normative plant availability factor (PAF) of each plant, NHPC earns fixed ROE (of 15.5 per cent) over and above recovery of expenses such as operations and maintenance and interest on loans.

The company also earns incentives based on its plants reporting PAF more than the normative levels (85 per cent) and deviation charges where the power station of the company contributes towards maintaining grid stability.

A hydro-electric power plant, once commissioned, incurs lower generation-based expenses and has a higher life compared to other sources. However, setting up a hydro plant is a lot more time-consuming process and involves higher fixed cost (capex) on a per MW basis compared to other power generation sources.

Intermittency issues of solar and wind can lead to sudden power generation shortfalls or excesses, which can affect grid stability, resulting in outages. Here, hydro power comes into the picture due to its ability to ramp up/ramp down quickly. Hence, combining hydro power with solar and wind can enable clean energy transition with grid stability.

Performance

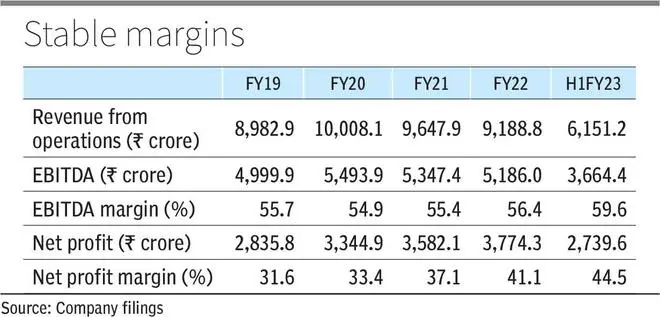

During H1FY23, NHPC’s generation amounted to 18,048 MUs, which is about 5 per cent higher on a Y-o-Y basis. The company’s PAF during the period stood at 99.23 per cent, up from 95.23 per cent last year mainly on account of higher water availability and restoration of Sewa-ll Power Station. The company has thus earned incentives amounting to ₹472 crore during H1FY23 against ₹398 crore in H1FY22.

Revenue from operations increased by about 15 per cent on a y-o-y basis on account of higher generation and increase in revenue from power trading segment and incentives. The company’s EBITDA increased by 10 per cent to ₹3,664.43 crore during the period. Its EBIDTA margin contracted to 59.6 per cent, from 62.3 per cent, on account of increase in generation expenses due to applicability of water cess from Uttarakhand and Sikkim. This was compensated by lower employee cost and interest cost.

Despite being a capex-driven company, NHPC has a pretty strong debt profile with D/E hovering in the range of 0.5-0.8 times and a healthy interest coverage of more than 10 times. This, along with assured return model resulting in stable cash flows, allows the company room for capex and stable dividend payouts ranging 50-60 per cent with dividend yield of around 4 per cent.

Outlook and valuation

The company has targeted an annual capex of around ₹8,061 crore during FY23 which is quite higher than the last few years. As per management, NHPC shall incur capex of similar levels in the coming years considering the project pipeline. In the hydro space, the company has about 6,434 MW of projects under construction. It has also announced its foray into solar and various solar assets with an aggregate capacity of 5.2 GW are under construction. Further, as per the management, the company is carrying out feasibility studies for pumped hydro storage projects of about 1,325 MW.

The stock of NHPC trades at nearly 10 times its one-year forward earnings, which is about 20 per cent higher than its historical five-year average P/E. However, the valuation can still be considered attractive, and make a case for accumulating the stock in view of the company’s growth prospects and assured earnings model. However, investors should also take into account execution-related risks of projects.

Risks

Along with higher initial costs, the construction and commissioning of hydro-electric projects face several risks such as geological uncertainties, time and cost overruns, legal and clearance issues and opposition from certain groups. Execution of two of the company’s major projects, namely Subansiri Lower (2,000 MW) and Parbati-II (800 MW), has faced delays on account of geological complexities and clearance from the National Green Tribunal. Further, floods have also contributed to the delay in tunnelling process of Parbati-II project. These projects are now expected to be commissioned by FY24.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.