Zydus Lifesciences, which had only recently changed its name from Cadila Healthcare, faced swings in its stock price, far more intense than the broader market in recent periods. The stock corrected by 28 per cent from its 52-week high in June-2021 to January-2022 and followed it with another round of 28 per cent correction to March-2022. The Nifty-50 index returned 2.8 per cent in the same period (June-2021 to March-2021) while S&P BSE Healthcare index declined by close to 10 per cent.

While the earlier correction may have reflected the changed economic interest in vaccine opportunities for Zydus Lifesciences, the latter correction owing to higher pricing pressure in the US and increased raw material cost concerns, may present a good buying opportunity for long-term investors. The earnings growth potential for the stock may be back end-loaded (FY23-24), as plant concerns for US and product ramp-up in India take effect. But the stock trading at 15.9 times FY23 earnings appears to be ignoring such growth, trading lower than its historical rate or even its peers.

India business

Zydus Lifesciences is the fourth largest pharmaceutical player in the country with a market share of 4.25 per cent for FY21, which also includes a sizeable biosimilar portfolio. Zydus Lifesciences developed and successfully marketed a broad Covid-19 portfolio, including favipiravir, remdesivir and others which expectedly inflated the domestic revenues in the last two years. Even as the company may sustain the higher base, the revenue growth may be optically weaker in the next two years.

Zydus Lifesciences missed a sizeable opportunity with ZyCoV-D, an in-house developed DNA vaccine for Covid-19, owing to manufacturing delays. Deliveries started only in February-2022, the fag end of the current wave. The company has a purchase order from government for supply of 1 crore vaccines at a price of ₹265 per jab and ₹93 for the needle-free applicator.

With the infection risk waning currently, the product’s peak estimates, beyond the current order, may not be encouraging. Additionally, Shilpa Medicare has been outsourced for drug production as well. Saroglitazar and Desidustat are two products developed by Zydus Lifesciences which management estimates can generate peak sales of ₹200-250 crore each in the next two-three years. Saroglitazar is approved by DCGI for type 2 diabetes, NASH and NAFLD (both are related to liver cirrhosis) in the year 2020. Desidustat has applied for approval in treating anaemia in chronic kidney disease for patients on dialysis or not. Zydus Lifesciences can explore the drugs potential in similar markets like China or other emerging countries as well.

Aided by strong performance in core therapies (anti-diabetic, cardiovascular, gynaecology and anti-infective), a delayed start in Covid-19 vaccine and promising pipeline launches, Zydus Lifesciences aims to sustain the high base of last year. Zydus Lifesciences’ consumer wellness portfolio (Complan and Glucon D) adds a different lever for growth if the company can drive higher penetration with smarter spend on reach.

US formulations

Amidst resurging pricing pressure in US generics, Zydus Lifesciences’ US segment growth is predicated primarily on US FDA clearance for Moraiya plant. This plant has been facing severe regulatory action for most part of the past 6 years. There is a dual impact on Zydus Lifesciences currently as the remediated Moraiya plant is awaiting inspection for clearing the backlog of launches while the delay is invalidating pipeline prospects owing to price erosion. In the absence of high-value launches, the curtailed launch size from 35 products to around 20 for FY22 will impact sales growth.

Zydus Lifesciences relied on limited competition products, Lialda, Tamiflu, Asacol HD and Androgel, for instance, which invariably get crowded and have magnified the impact of price competition in the last two years. Currently only one molecule can expect sharp cut in realisations (Asacol HD) as others have been cut to size. This, along with a broader launch plan of close to 50 launches per year (given plant clearance), can hedge the pricing risk to an extent. On the value side of the portfolio the company plans on research-based products (as against invalidating patents earlier) from injectables and repurposed products (505(b)(2) applications). One such programme for treatment of a rare indication (Menkes disease) has filed a new drug application in the US which, on approval, could provide a significant opportunity for Zydus Lifesciences in FY23-24.

Financials and valuation

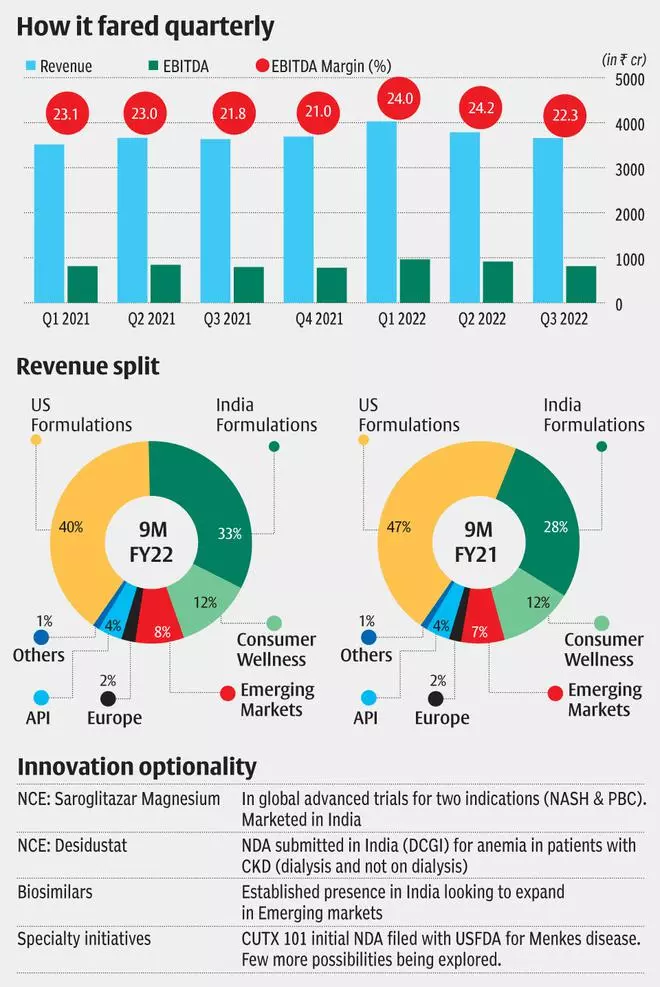

Zydus Lifesciences’ net debt to EBITDA has improved from 1.08 times as on FY21 end to 0.16 times in 9MFY22 end following proceeds from Animal division sales, based on which the company may be willing to consider potential acquisitions in the US speciality space. Revenue grew by 6 per cent YoY to ₹11,465 crore for 9MFY22 and, more importantly, the company managed to marginally improve EBITDA margins (20 bps improvement to 23.5 per cent) owing to cost control and inventory management. In the face of rising raw material prices, Zydus Lifesciences is investing in operational efficiency aiming for 80-100 bps improvement in margins by FY23.

Owing to missed vaccine opportunity and elevated pricing concerns from US markets, the stock corrected more than warranted by risks. A small vaccine contribution and ramp up from new label launches (Saroglitazar and Desidustat) in India and diverse portfolio in the US are not reflected in the stock price trading at 15.9 times FY23 earnings. This is below Zydus Lifesciences’ historical average of 19x and peers’ valuations range, including 18 times FY23 for Dr. Reddy’s, 21 times for Lupin and 23-24 times for Sun and Cipla which are higher up in the pecking order.

As shown in the table, the range of trials under way (accounting for significant investments) is are at a stage where any value cannot be reliably ascribed and hence to be treated as options that investors acquire, further at such low valuations in Zydus Lifesciences. The Saroglitazar programme, in particular, is being tested in advanced trials across two indications, Primary Biliary Cholangitis (orphan drug designation allowing for better exclusivity and fast track status assigned by FDA) and NASH and another indication in post-transplant condition. The vaccine programme at Zydus Lifesciences is also an aggressive campaign which is expected to go beyond Covid-19 (two-dose trial under way) into flu and other areas as well. The biosimilar programme has a strong base in India and the company may reach out to EM’s as well in the future.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.