PVR stock got two pieces of positive news in the past two weeks. Firstly, PVR received a verbal order from NCLT approving of the merger with Inox Leisure – the other major chain film exhibitor. Second, Hindi film content may be showing signs of shedding its content challenges with the positive reception for Pathaan – a tent pole project for the industry.

The stock is trading at 35 times FY24 expected earnings based on consensus earnings estimate, which has not yet factored the merger. While the merger will be followed by a period of consolidation-related costs, longer term earnings should be on a higher growth path, making for reasonable point of entry. With near doubling of capacity post-merger, which is coinciding with a period of recovery in operational metrics of the company (price, cost and occupancy), we recommend investors buy the stock of PVR.

Merger and economies of scale

From receiving the written order by January 25-31, 2023, (T), PVR expects to have the record date for the share swap (3 shares of PVR for 10 shares of Inox) in T + 20 days. With a combined screen capacity of 1,625 screens now (902 for PVR and 722 for Inox), the combined entity will account for more than half of the country’s multiplex film screens, when the merger goes through.

Going by Q2FY23 results, Inox revenue proportion is similar to PVR. Half from tickets, 30 per cent from food and high single digits each from advertisements and others — promotion, distribution. But while both the players are recovering, average ticket price per person (ATP) and spending per head (SPH) of Inox are 5/20 per cent behind PVR and have always been. While PVR occupancy recovered to 24 per cent in Q2FY23, Inox was still behind at 17 per cent. These metrics, some of which are due to structural factors like location, product and geographic mix, will pull the consolidated entity’s metrics below PVR’s standalone operations.

But synergy benefits, which are not yet detailed by the companies, will be significant as well. The combined brand will be the leading option for upcoming mall developers, who are willing to give anchor tenant status to PVR or Inox driving better terms on rentals. Costs from movie exhibition (38-50 per cent of gross box office) should decrease by 100-200 basis points at least, as the two exhibitors consolidate. PVR’s better F&B offering, scope for mapping movie releases geared towards higher occupancy, and obvious cost savings from the combined entity should drive the low hanging synergy benefits.

Gradually recovering metrics

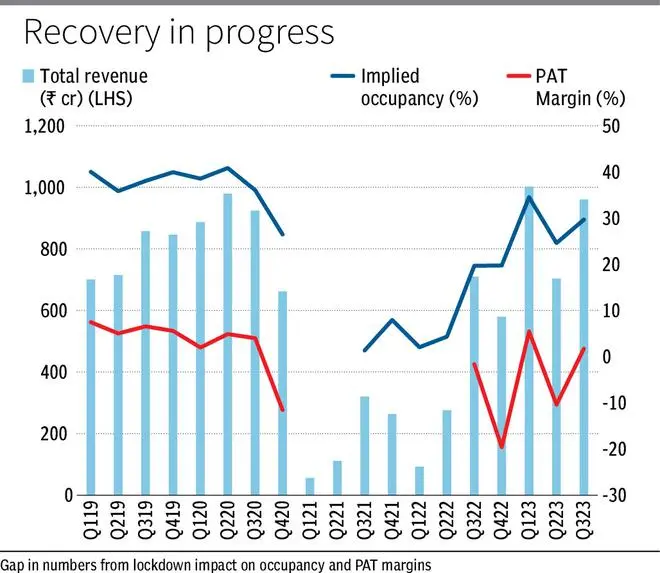

With high fixed expense from rentals, employee costs and interest, occupancy is the key metric to profitability. In pre-pandemic FY19 period with an occupancy of 36 per cent, PVR reported 6 per cent PAT. Currently the metric is at 29 per cent in Q3FY23 compared to 20/34/24 per cent in earlier three quarters. Even after re-opening, weak content from Hindi language and low releases from English have held back the recovery, but offset by regional content. But even as content quality is volatile, the positive reception of Pathaan weakens the narrative of cancel culture against Hindi movies. OTT platform is cited as another reason. But even production houses are backing theatrical releases first (which allows for higher profits) against an OTT launch (which is based on cost-plus margin models). The release schedule is expected to move back to OTT launch after eight weeks from the current four weeks model being followed.

According to our estimates, on a wider base of 1,700 screens, a low occupancy estimate of 27 per cent, cost savings from synergies adding 300 basis points to PAT margins and share swap resulting in 1.6x dilution, the combined entity should generate revenue and EPS CAGR of 15 and 10 per cent from FY19 (last normal year) to FY25 (period of basic consolidation).

With the continuing trend of premiumisation in consumption, average ticket price of around ₹220 can sustain 3-5 per cent pricing growth yearly. The management anticipates that the cash flows from the combined entity should support 200 screen additions yearly, which should ensure atleast 7-8 per cent volume growth. This implies a low double-digit earnings growth for the industry leader. The SPH metric has risen strongly from ₹90 in FY19 to ₹130 in TTM and is expected to sustain. Advertising income has yet to recover to pre-pandemic levels (₹35 per admit in FY19 to ₹25 in TTM), but with improving footfalls, advertising income stream will also recover.

Financials

PVR revenues barely inched past pre-pandemic levels (₹979 crore in Q2FY20) in last twelve months but on a higher screen base (by 6 per cent) and high volatility of revenues. Occupancy and hence revenue and profitability were impacted by English content (# of releases) in Q2FY23 and Hindi content (quality) impacted Q3FY23. PVR’s gross/net debt at ₹1,500/1,180 crore in Q3FY23 implies a net debt/annualised EBITDA ratio of 0.7x, but profitability has to sustain at current levels to support debt servicing.

The primary risk to occupancy of the larger combined entity is content flow, which can be transitory. But structurally, the company is poised to be the industry leader in entertainment services and will leverage the tail winds from increasing disposable income of the country over an established and built-up cost base in the future.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.