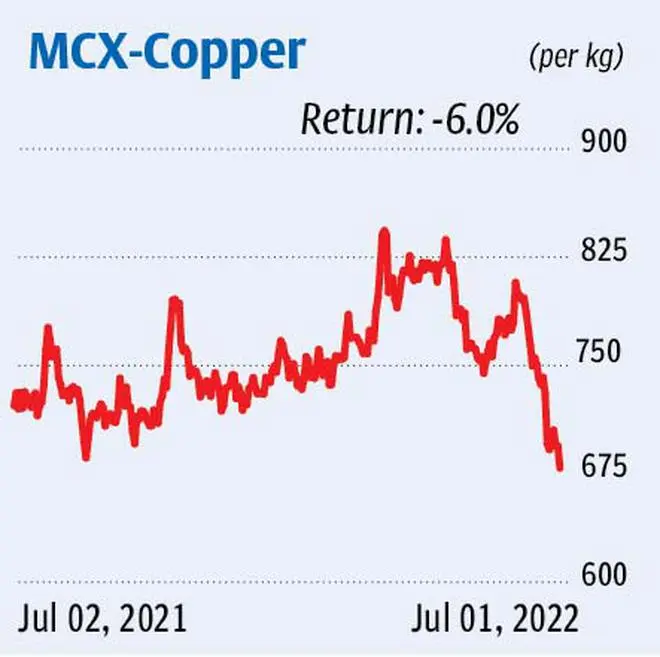

Over the past month, the relentless selling in copper futures (continuous contract) on the MCX (Multi Commodity Exchange) resulted in its hitting a 52-week low, marking a low of ₹672.15 before wrapping up the week at ₹679.

Nevertheless, the price range of ₹660-675 is a considerable base. The 38.2 per cent Fibonacci retracement level of the rally between March 2020 and March 2022 coincides at ₹675, making the support stronger. Also, the relative strength index (RSI) on the daily chart is now at oversold levels. Hence, there could be a bounce at the support band of ₹660-675.

There is no denying that the overall bias continues to be bearish. Yet, given the contract has fallen sharply and hovers around the support area, the case for a corrective rally looks reasonable.

Traders holding short positions can liquidate at the current levels. Going forward, the following are the alternatives that we suggest. One, short copper futures if it breaches the support at ₹660; place stop-loss at ₹700. When the contract falls below ₹620, tighten the stop-loss to ₹640. Exit the shorts at ₹590.

Two, wait for the contract to rally to ₹720 and then go short. Keep stop-loss at ₹750. Alter the stop-loss to ₹700 when the contract slips below ₹660 and tighten it further to ₹640 when copper futures move below ₹620. Liquidate at ₹590.

However, a rally above ₹720 can build positive momentum and consequently, appreciate to ₹760 and possibly to ₹780, which are the notable barriers.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.