The Indian benchmark indices, the BSE Sensex and NSE Nifty 50, fell sharply last week thereby snapping their three-week rally. Both the indices were down over a per cent each last week. However, last week’s fall has not made any disruption on the charts. The overall picture is still bullish.

Indeed, the price action on the daily chart indicates that Sensex and Nifty 50 lacks fresh and strong sellers to drag them below their key supports. This keeps the overall sentiment positive. As such, we can expect the benchmark indices to see a fresh rally again going forward.

The sectoral indices were mixed with some falling sharply and some managing to close in the green for the week. The BSE Oil & Gas, BSE PSU and the BSE FMCG indices were up over a per cent each last week. On the other hand, the BSE IT index was beaten down the most. The index was down 5.5 per cent last week.

FPI action

The Indian equity market saw a marginal foreign money outflow last week. The Foreign Portfolio Investors (FPIs) sold $14.77 million in equities. However, the month of April has seen a net inflow of $1.05 billion.

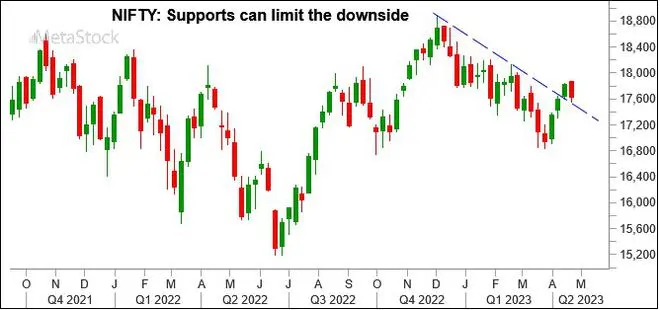

Nifty 50 (17,624.05)

The resistance at 17,875 mentioned last week has held very well. Nifty made a high of 17,863 and fell sharply giving back all the gains. But at the same time the support at 17,530 has also limited to downside very well. Nifty made a low of 17,553.95 before closing the week at 17,624.05, down 1.14 per cent.

The week ahead: The price action on the daily chart indicates that Nifty is getting bought below 17,600. Immediate support is around 17,600-17,585. Below that, 17,550 and 17,520 are the next important supports for the week. The channel support is at 17,480. So, this support cluster leaves the chances less for the Nifty to see a sharp fall from here unless any new negative trigger comes.

As such, we can expect the Nifty to break the immediate resistance at 17,700. Such a break can take it up to 17,850 initially. A further break above 17,850 will see the upside extending up to 18,000 and even 18,200.

Graph Source: MetaStock

Medium-term outlook: The medium-term outlook is bullish. As mentioned last week, 18,000-18,200 is a crucial resistance zone. As long as the index sustains above the support at 17,480, the chances are high for it to break above 18,200. Such a break can take the Nifty up to 19,000 initially. It will also strengthen our long-term bullish view of targeting 20,000-20,500 on the upside.

To negate the rise to 19,000, Nifty has to break below 17,400 initially and then 17,000 subsequently. In that case, a fall to 16,000 and lower levels will come into the picture. But that looks less likely at the moment.

Sensex (59,655.06)

Sensex failed to rise above the resistance at 60,500. The index made a high of 60,407.86 and then fell sharply giving back all the gains. However, the support at 59,450 mentioned last week has held very well. Sensex made a low of 59,412.81 and has risen back to close the week at 59,655.05, down 1.28 per cent.

The week ahead: Immediate support for the week is at 59,400-59,300. Below that 59,000 is the next important support. Resistances are at 59,900 and 60,300. The near-term outlook is mixed. For now, the broad range of trade can be 59,000-60,300. A break above 60,300 can see an extended rise to 61,000.

The short-term outlook will turn negative only if Sensex falls below 59,000. In that case, 58,300-58,000 can be seen on the downside.

Graph Source: MetaStock

Medium-term outlook: As mentioned last week, Sensex is not looking as strong as Nifty. The breakout that is visible on the Nifty is yet to happen in Sensex. However, on the long-term charts, 57,000 is a very crucial support. As long as the index sustains above it, the bias is positive. That will keep alive the chances of breaking above the 61,000-61,300 resistance zone. That break will take the Sensex up to 64,000 and 66,000 over the long-term.

Sensex has to make a monthly close below 58,000 first and then a subsequent fall below 57,000 to turn bearish from a medium-term perspective.

Nifty Bank (42,118)

The Nifty Bank index opened the week on a volatile note. The index opened with a wide gap-up at a high of 42,603.55 on Monday and then fell from there. However, barring the volatile movement seen on Monday, the price action for the rest of the week was stable. The support at 41,700 mentioned last week is holding very well. The Nifty Bank index has closed on a flat note at 42,118.

Graph Source: MetaStock

For this week, immediate support is around 41,800. Below that 41,700-41,680 is the next strong support. The moving average indicators are also giving positive signals. This leaves the chances high for the index to sustain above 41,800 itself this week. So, the outlook is bullish, and the Nifty Bank index can rise to 43,000 and 44,000 in the short term. Such a move will also strengthen the long-term bullish outlook for the Nifty Bank index to target 48,000 and higher levels in the coming months.

If the index breaks the support at 41,700–41,680, it can fall to 41,000–40,800. A fall beyond that is unlikely.

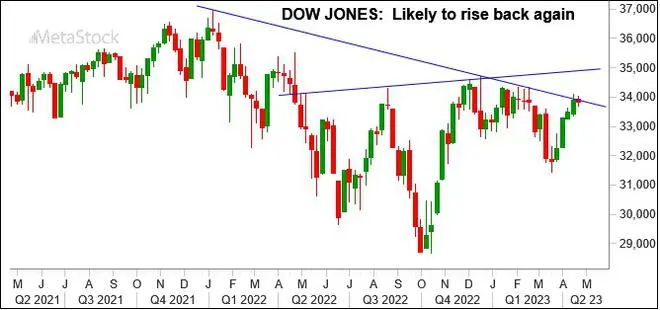

Dow Jones (33,808.96)

The Dow Jones Industrial Average was stuck between the support at 33,700 and resistance at 34,000. The index attempted to breach 34,000 initially, but failed to sustain. The Dow Jones made a high of 34,018.62 and has come-off from there. It has closed the week at 33,808.96, marginally down 0.23 per cent.

Graph Source: MetaStock

The key resistance at 34,000 is holding well. However, the price action on the daily chart indicates lack of strong selling pressure. So, the chances are high for the index to sustain well above the support at 33,700 and break 34,000. Such a break can take the Dow Jones up to 34,500-34,700 and even 35,000 in the coming days. That will also strengthen the long-term bullish picture.

In case the Dow Jones breaks below 33,700, the next supports at 33,400-33,350 can limit the downside.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.