Tech giant Apple Inc. is well-positioned to take a bite out of the financial services market with its growing payments ecosystem, despite some recent product delays. Here are 4 charts that give more details of Apple’s fintech play.

Growing presence

Apple is expected to continue to broaden its fintech footprint. It has a number of advantages that should help. Those advantages include consumer affinity, trust in Apple’s brand and an active device install base.

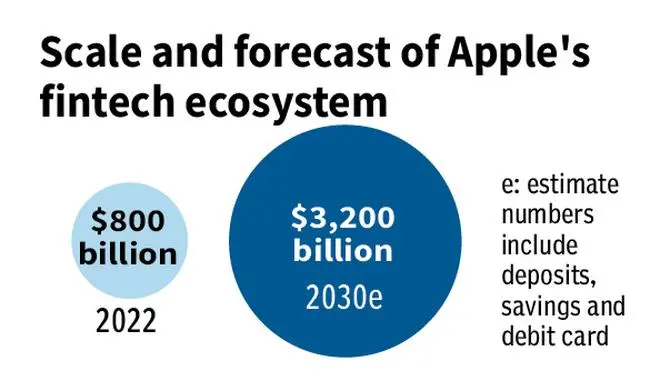

It is estimated that in 2022, Apple controlled about $800 billion of payments volumes (noting that, for example, Apple does not literally process Apple Pay transactions as they flow from merchants to card issuing banks via Visa/Mastercard; though Apple is in the corresponding stream of data). It is anticipated that these flows to grow to $3.2 trillion (3200 billion) by 2030, a compounded annual growth rate of 19 per cent from 2022. Do note that a material portion of this growth will come from services not in-market today.

Go with the flow

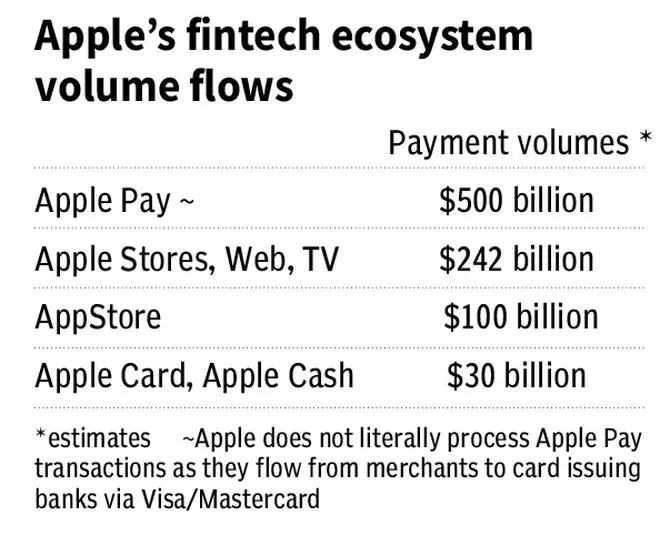

Apple Pay is the largest source of Apple’s fintech flows. Apple publishes little data on Apple Pay. But sometime ago, it was revealed that Apple Pay reached 1 billion transactions per month. There are estimates that Apple Pay is just under half the size of PayPal by volume of flows.

The second largest source of fintech flows are the payment volumes that Apple accepts as a merchant, including Apple’s own product/service sales channels (Apple stores, Apple.com, and Apple’s music/TV/video channels) and the App Store. Interestingly, the App Store is Apple’s most lucrative fintech platform.

Volumes arising from Apple Card and Apple Cash are modest. It appears Apple is focussed on building out their portfolio of consumer services including Apple Pay Later (slated for launch in 2023), savings accounts (recently announced as an add-on to the Goldman Sachs issued Apple Card).

A distribution of estimated flows across the range of apple touchpoints can be seen below.

How Apple fintech system evolved

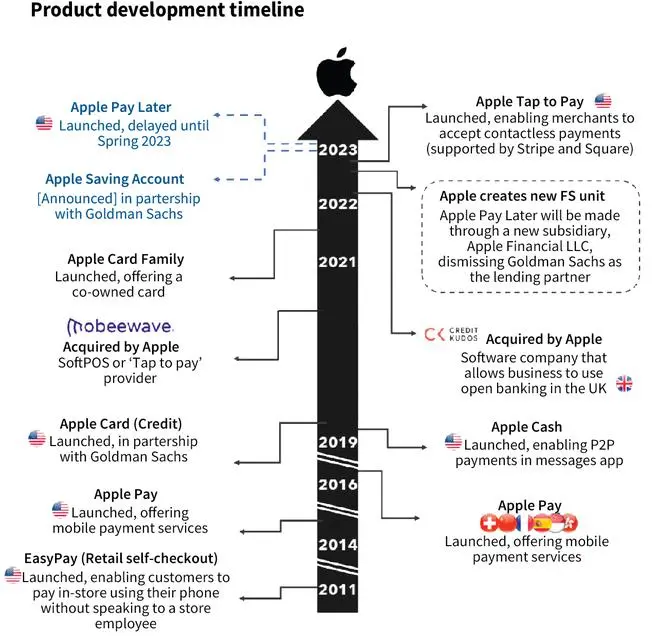

Over the past decade, Apple has launched an array of financial services, starting with its digital Wallet app and its digital payment system Apple Pay. Apple Card, the company’s digital credit card that launched in 2019, counted nearly 7 million users as of early 2022, as per estimates.

Courtesy iPhone and Apple Watch, Apple has the advantage of a massive customer base. A stream of tailwinds is driving Apple toward the fintech and payments market, including the increased adoption of digital wallets. Also, factors such as greater prevalence of merchants accepting QR codes and instant payment features, and a rising appetite from regulators to encourage competition against the duopoly of Visa and Mastercard, also helped.

Do note that Apple relies on many partners today to enable its broad range of fintech services.

Services mettle

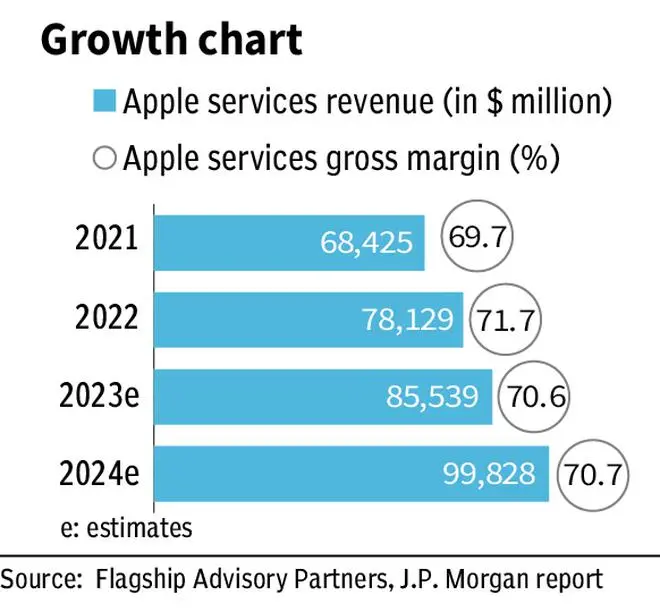

Apple, with its rich and expanding portfolio of unique fintech services, is a key actor in developing the global fintech industry. The transformation of the company into a services juggernaut is often not noticed by many, who still consider Apple has a products company. Here are some numbers on how Apple’s services segment has grown and the healthy gross margins it enjoys.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.