It has been two years since the Reserve Bank of India raised interest rates. And it has been 14 months since the last hike. When rates hikes stop or peak out, longer-duration debt securities are expected to do well subsequently. Yet, the best returns continue to come from the safest of short-term investments and not via longer tenure securities.

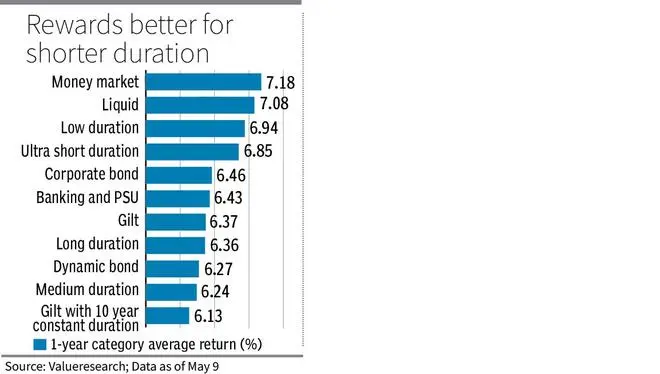

Taking the one-year returns for various debt fund categories, money market, liquid and low-duration funds have delivered the highest returns. Banking and PSU debt, and corporate bonds take the middle slot.

The lowest returns in the last one year have been generated by fund categories such as gilt, gilt with 10-year constant maturity, and long- and medium-duration funds.

- Also read: Editorial. Prudent move

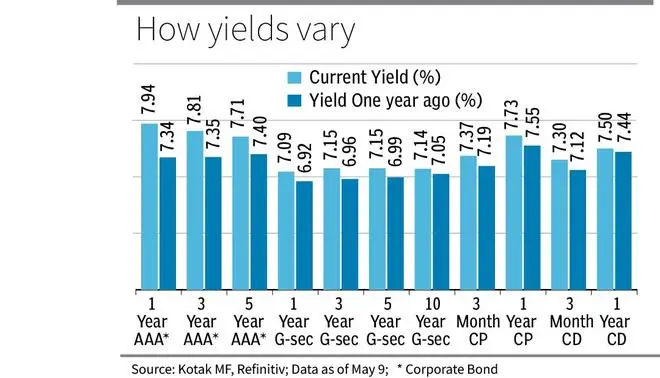

Additionally, going by the current yields available in the secondary market across different tenors for securities, it seems likely that the trend will continue for the foreseeable future.

The RBI’s somewhat rigid interest rate stance and the banking system’s tight liquidity may be the prime reasons for the shorter end of the yield curve delivering more.

‘Safe’ fund categories shine

Money market and liquid funds as categories delivered 7.18 per cent and 7.08 per cent on average, respectively, in the last one year. Low duration and ultra-short duration funds managed 6.94 per cent and 6.85 per cent, respectively, according to data from Value Research. These funds typically invest in treasury bills, short-term government and corporate securities and typically the maturity profile is from a few weeks to a few months.

At the middle of the yield curve, corporate bond and banking and PSU debt funds delivered only 6.46 per cent and 6.43 per cent, which is 40-75 bps lower than money market and other funds that delivered well. Corporate and banking and PSU debt funds typically invest in securities with maturities running to 3-5 years on average.

The performance at the bottom rung of the ladder was from long-duration, gilt, dynamic bond, medium duration and 10-year constant maturity gilt funds. These funds managed only 6.13-6.37 per cent on an average in the last one year, a good 80-100 basis points lower than the best performing categories.

Scenario to continue?

The situation looks like it is set to continue into the foreseeable future as well. Data compiled by Kotak Mutual fund (sourced from Refinitiv) indicates that 1-year AAA rated corporate bonds (CDs), 1-year commercial papers (CPs) and 1-year certificate of deposit yields are in the 7.5 per cent to 7.94 per cent range. Three-month CPs and CDs also offer reasonably high yields.

Thus, money market, liquid, ultra-short duration funds that invest in these securities are likely to yield more for the near future. Given that these funds carry almost no credit risk and also no interest rate or duration risks, investors, including corporates, may continue to evince interest.

Even though inflation has remained under control, the RBI has maintained its ‘withdrawal of accommodation’ stance, which means money supply will be reduced.

For much of the last few months, barring short periods, the banking system’s liquidity has been in deficit. In the latest week, as of last Thursday, the deficit stood at ₹1.77-lakh crore.

The tight monetary stance and the liquidity deficit keep up the pressure mostly on short-term securities, thus increasing the coupons and yields on them.

For investors looking to maintain their emergency corpus or short-term investments via debt funds, money market and liquid schemes continue to be attractive.