The Sensex crashed 900 points or nearly 1.5 per cent on Thursday. With volatile domestic stock markets over the past few sessions, long-term investors can add positions in equity asset class via Systematic Investment Plans (SIPs) in a mix of steady large-caps and growth-oriented mid-caps. The four-year-old Motilal Oswal Large and Midcap Fund can provide the ideal return recipe if your holding period is five years or more. A good performer backed by a quality and growth-oriented style focused on industry leaders, the fund’s 50 per cent in large caps and 50 per cent in mid and small caps allocation strategy and basket approach to play identified themes in the portfolio holds it in good stead. Here’s a lowdown.

Competitive performance

Launched in October 2019, Motilal Oswal Large and Midcap Fund has performed reasonably well. While 2020 was a forgettable year, the fund gradually improved its show in 2021 and 2022. In 2023, year to date, the fund has achieved top quartile ranking among peers.

Motilal Oswal Large and Midcap currently holds 43 per cent in large caps, 35 per cent in mid-caps, and 22 per cent in small caps in allocation. Compared to the benchmark, the fund is over-weight on small caps.

Its small-cap strategy is centred around allocation towards larger companies in that sub-set, with majority exposure (64 per cent) towards healthcare play, which is defensive in nature and may be an effective buffer when equity markets turn more volatile.

Overall, the portfolio construction orientation of the fund is towards risk-adjusted long-term growth with lower volatility. There is no strategic use of cash by the fund, i.e. it remains generally fully invested.

The fund has outdone its category average returns across one- and three-year periods and outperformed the benchmark Nifty Large Midcap 250 Total Return Index (TRI). Alpha (over benchmark) is 600 basis points in one year and about 400 basis points in 3 yearss.

In terms of upside capture, the fund (102 per cent) has done better than the benchmark. During downsides, it has shielded investors by falling only 90 per cent of the benchmark.

Portfolio and strategy

Motilal Oswal Large and Midcap combines top-down sector/theme view with bottom-up stock selection. It prefers diversification across sectors (19).

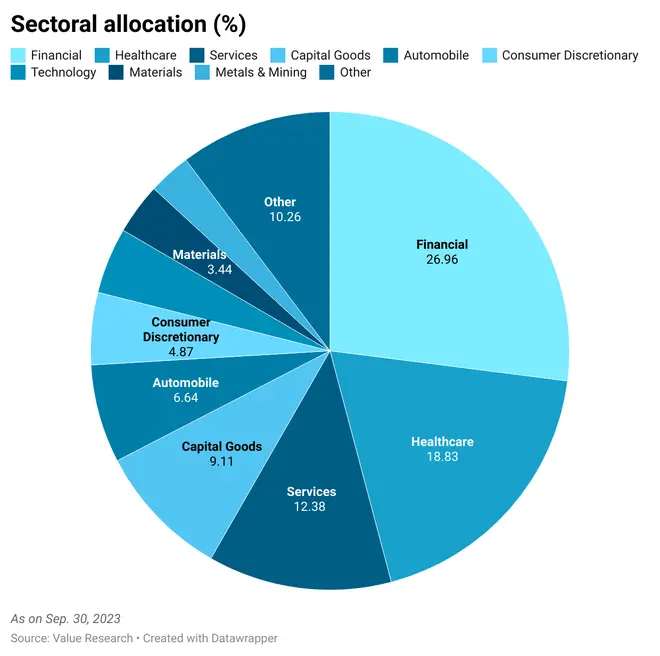

The fund utilises a basket approach to play identified themes in the portfolio. The current themes are healthcare (25 per cent), consumption (23 per cent), lenders (21 per cent), and manufacturing & capex (17 per cent). IT (per cent) and chemicals (7 per cent) are smaller plays. The fund adopts a quality and growth-oriented equity style focusing on industry leaders.

Typically, the fund maintains a compact portfolio of approximately 35-40 stocks compared to most peers with 50-80 stocks. Its top-10 holdings are Trent, Cholamandalam Investment, Federal Bank, Global Health, Infosys, Fortis Healthcare, Glenmark Pharma, ICICI Bank, Interglobe Aviation, and Mankind Pharma.

Sectorally, banks are the top allocation, followed by industrial products, healthcare services, finance, pharmaceuticals & biotech, retailing, insurance and consumer durables.

In the past three months, the fund has bought Concord Biotech, Gland Pharma, Glenmark Pharma, HDFC Bank, InterGlobe Aviation, Jupiter Life Line Hospitals, NTPC, Netweb Technologies, SBFC Finance and Timken India. On the other hand, it has exited Ashok Leyland, Gujarat Gas, Kajaria Ceramics, SBI, Ultratech Cement and United Breweries.

Regarding the current portfolio strategy, the fund is overweight healthcare and aims to play the same across the spectrum – pharma, hospitals, health insurance and diagnostics. In the consumption space, the fund prefers discretionary over staples.

In the capex/industrials space, the fund is gradually increasing exposure. It is also overweight lenders because of its relatively reasonable valuation and promising outlook. Notably, Motilal Oswal Large and Midcap is underweight IT.

Although the fund exhibits a more aggressive investment style, like higher exposure to small-cap stocks (22 per cent), its execution has been decent thus far.

Note that the fund’s expense ratio (59 basis points) is cheaper than the category (85 bps).

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.