From being a monotonous bunch, PSU stocks have transformed into leading return generators for most investors in the last year. With the government assuming a coalition mandate, all eyes are now on PSU stocks. The Cabinet formation, the first Budget presentation and companies’ first quarterly calls post elections will be the key monitorables for investors before extrapolating the wild ride of the last few years.

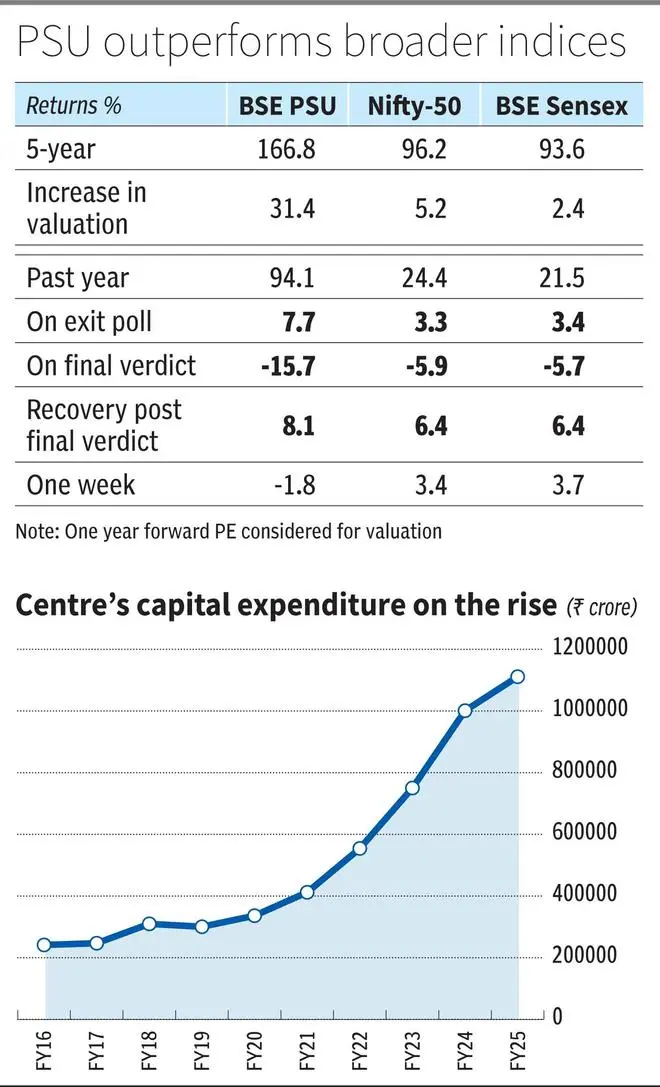

The S&P BSE PSU index returned 167 per cent in the last five years, beating both the Nifty-50 and BSE Sensex at 96 and 94 per cent, respectively. A good part of this can be ascribed to the jump in valuations, which moved from 9 times one-year forward earnings in June 2019, to 12.2 times now – a 31 per cent rise. The bellwether indices’ valuations have only expanded by 5 and 2 per cent in the period. In contrast, a large part of the gains of the PSU index came about last year when it returned 94 per cent, compared with the 22 per cent average of the Nifty-50 and BSE Sensex.

The recent rally saw significant volatility, with the PSU index gaining 8 per cent on the exit polls, then dropping 16 per cent on the verdict, and now down 2 per cent from last Friday.

The tentative recovery points to investors scepticism on the segment, and rightfully so.

Slowing tailwinds

Post Covid, the budgeted capital expenditure of the government has risen at a pace of 28 per cent CAGR from ₹4-lakh crore in FY20-21 to ₹11-lakh crore for FY24-25. For comparison, the pace of expansion was at 13 per cent from FY16 to FY20. Across railways, power, defence, roads and communications, the increased budget outlays have gradually impacted the order books and profitability of PSU stocks operating in these sectors positively.

The scepticism in the PSU sector stems from the speculation that this pace of growth may not be maintained in the next few years and government spending may lean more towards welfare expenditure. While signs of rural distress were evident from studies in the public domain to management commentary of FMCG stocks, the recent verdict may also be taken as a more important sign for the impending welfare tilt. The much-anticipated recovery in private capex was expected to take over from government capex. But even the private sector may wait for cues from the new government.

Outlook clouded

The strong order books have driven valuations in the sector, apart from a better return metrics and lower leverage. Defence companies have an order book of 3-4.5 times revenues.

These order books can be deflated or delayed if there is a change in policy or direction of spending. The higher order priorities – defence orders for Tejas (Hindustan Aeronautics), INS Vikrant (Mazagon Docks) and missile systems (Bharat Dynamics and Bharat Electronics) – may face slower change. Similarly, priority in power generation and rail fleet modernisation may fall within new government priorities as well. But second order impact of a change in pace of capex will take a toll on pace of executions, profitability and hence return metrics.

Investors will have to bake in a higher margin of safety from the current valuations until a clarity emerges on each company’s outlook. They can find confidence in the PSU sector as the Centre’s capex has significantly increased in recent years. However, further growth will be challenging, given the higher base now at 2.7x compared with four years ago. Post-election quarterly reports from companies will reveal the sector’s new direction. .

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.