With the markets giving double digit returns in the last two Diwali years, it remains to be seen if there will be a hat-trick. Samvat 2080 had it all. It saw a full-blown conflict in the Middle East, India’s general election frenzy, and the US Fed slashing interest rates.

And, despite the choppiness in the run-up to Samvat 2081, the year just past was a cracker of a year in more ways than one. The Nifty and Sensex moved up by 24.7 per cent and 22.5 per cent, respectively, since last Diwali with the bellwethers touching all-time highs before retreating. More importantly, the rally extended across broader markets. Three in every 4 stocks from the BSE Allcap universe posted gains in this period.

More hits in large-caps

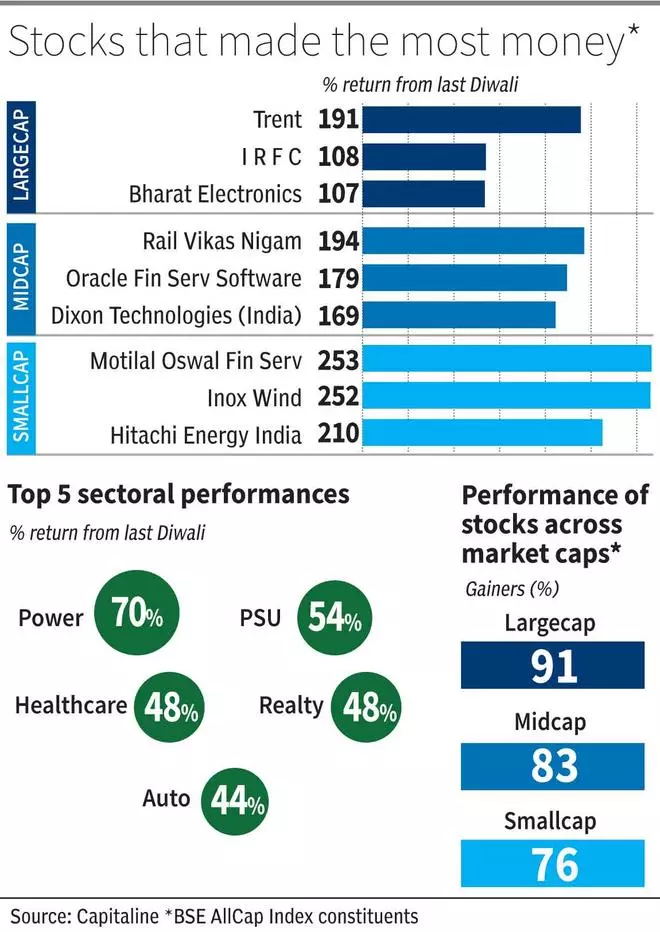

BSE Midcap (up 41 per cent) and BSE Smallcap (up 39 per cent) were big winners again in Samvat 2080 as had been the case during Samvat 2079. BSE Large-cap clocked 27 per cent gains. While the returns of the large-cap index look dull compared to Mid-cap and Small-cap counterparts, the stocks saw the highest hit-ratio with 9 out of 10 stocks showing positive returns during Samvat 2080.

Trent led the large-cap pack with 191 per cent returns, while IRFC, Bharat Electronics, Hindustan Aeronautics, Siemens and Zomato also made their way into the multi-baggers list with returns of 100-110 per cent. Mid- and small-caps had a slightly lower hit-rate of around 83 per cent and 76 per cent, respectively.

Rail Vikas Nigam led the mid-caps with an equally impressive 194 per cent return, followed by Oracle Financial Service Software and Dixon Technologies India with around 170 per cent. Among the three market-cap segments, small-cap stocks saw the highest returns on individual basis, with Motilal Oswal Financial Services and Inox Wind rewarding investors with a solid 250 per cent return.

That said, it is to be noted that around 1 in 7/ 6/ 5 stocks from the large-/mid-/small- universe, respectively, which gave positive returns, saw de-growth in EPS (trailing twelve month) in this period.

FMCG drags

Tailwinds in the form of increase in power demand and push to increase renewable energy capacities, backed by government support continued to drive power stocks. BSE Power led the sectoral charge with around 70 per cent returns in Samvat 2080. PSUs followed with around 54 per cent returns, despite a 15 per cent correction from their 52-week high since July 24, on concerns of dizzying gains and high valuations.

BSE Financial Services and BSE FMCG were the bottom-draggers with 21 per cent and 15 per cent returns, , respectively. Among financial services, banks face slower deposit growth rates and pressure on net interest margins. Asset quality concerns in segments such as microfinance loans has surfaced afresh. FMCG, on the other hand, is struggling to grow urban volumes with a shrinking middle-class being the key concern.

Outlook clouded

The run-up to Samvat 2081 was choppy with the Nifty falling 5.7 per cent in October. FIIs shifting funds to a rebounding China and slower earnings growth are key reasons for the decline.

With the markets giving double digit returns in the last two Diwali-years, it remains to be seen if there will be a hat-trick. An earnings slowdown amidst high investor expectations, apart from other global uncertainties, are key risks.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.