“Here, try these VR glasses on,” says a member of the XR/VR team at pharma major AstraZeneca’s Global Innovation & Technology Centre on the IT highway in Chennai. VR glasses on and you are ‘virtually’ sitting in a clinic with a doctor interacting with you. The glasses take one on a virtual tour of what a patient enlisted for a clinical trial would undergo, prior to actually going through it. “Patients who are going into clinical trials are worried about what will happen at the trials. So, we can give them a complete VR presentation; the whole experience is given before they get to the site and it makes them calmer,” says Siva Padmanabhan, Managing Director, AstraZeneca India Pvt Ltd.

Siva Padmanabhan, Managing Director, AstraZeneca India

There’s more happening at this global centre being built in Chennai. As Padmanabhan says, the centre is working on other end uses for global play. “We have very expensive shop floors with lots of sterile equipment so while training someone on a running machine that batch of medicines can get contaminated and has to be thrown away. Instead, we can give them the VR experience, with haptic gloves, which will give them the feel of touch. We can train them without stopping the machine; it’s a complete simulation.” Or, physicians can show patients how cancer drugs target cancer cells and how they work. “The chemistry can be animated and shown. The possibilities are limitless,” adds Padmanabhan.

AstraZeneca’s Chennai centre, which employs over 3,000, also provided critical tech inputs that helped the company globally develop and produce the Covid vaccine in 10 months flat, with its real-time insights based on data analytics, AI & ML. This centre ensured the scalability of the systems used to manage every element of the value chain – from clinical trials, procurement, supply chain and commercial operations.

In just eight years, what was AZ’s Global Technology Centre, has transformed to a hub of innovation and research for the pharma MNC worldwide — what is now in common parlance, a Global Capability Centre (GCC). AZ’s is just one of the GCCs that have mushroomed on the Chennai landscape. A NASSCOM official says the purpose of a GCC has transformed from being a cost advantage for an organisation to now a strategic business enabler and value creator. Key priorities now for the GCCs include, innovation and building enterprise talent.

Technology is core now

For example, in AZ’s case, till 2014, eight companies were delivering services for the pharma major on global contracts — from financial software, application development, commercial operations et al. “We decided to insource, as technology was becoming quite central to the business and we realised that without having expertise in tech, we couldn’t move fast enough to take on new opportunities, or for M&As or transform our processes or data, or go into a new therapy area or new geography. All of this requires a massive understanding of technology. It was becoming core to the business and is now a core capability just like marketing or manufacturing,” explains Padmanabhan.

During the pandemic, India attracted over 70 MNCs to establish their GCCs in the country. India is now home to over 1,430 GCCs as of FY21 and added 20 new GCCs in the Jan – March quarter of the current FY. The GCC sector revenues are almost $40 billion and growing at a CAGR of 11.7 per cent, employing around 15 lakh professionals. “GCCs are now focusing on high-value tasks such as developing intellectual property, growing expertise around developing technologies, establishing COEs, and fully taking control of vendor management,” says NASSCOM.

Lalit Ahuja, Founder and CEO of ANSR

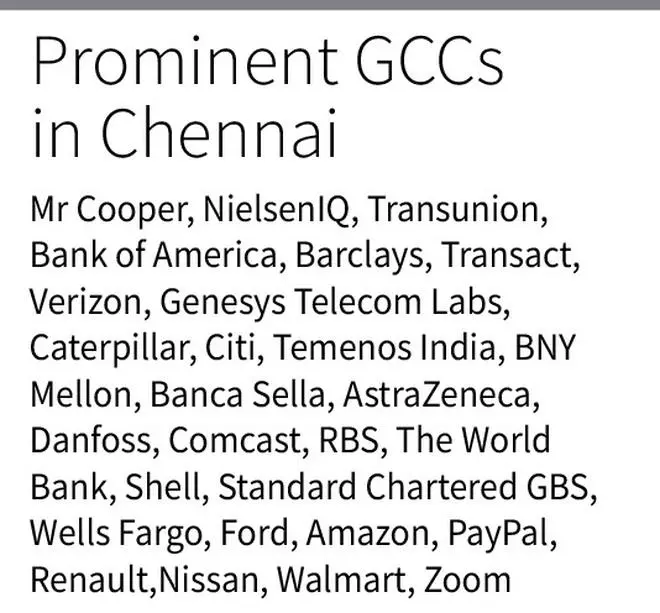

Lalit Ahuja, Founder and CEO of ANSR, a Bengaluru-based consultancy that helps global organisations accelerate digital transformation through GCCs, says that Chennai is one of the five major GCC hubs (Bengaluru, NCR, Hyderabad and Pune are the other main ones) with nearly 10 per cent GCC market share. GCCs, he says, now represent the fastest growing market segment of the Indian IT/ ITeS industry. “With the saturation of the traditional GCC hubs, Chennai has emerged as a huge beneficiary and represents one of the fastest growing GCC hubs in the country. The incredible growth of Chennai as a preferred GCC destination is driven by a combination of a thriving education ecosystem, abundant availability of high-quality technology and business talent, progressive State administration, lower cost of operations, world class infrastructure and the success of incumbent GCCs,” explains Ahuja.

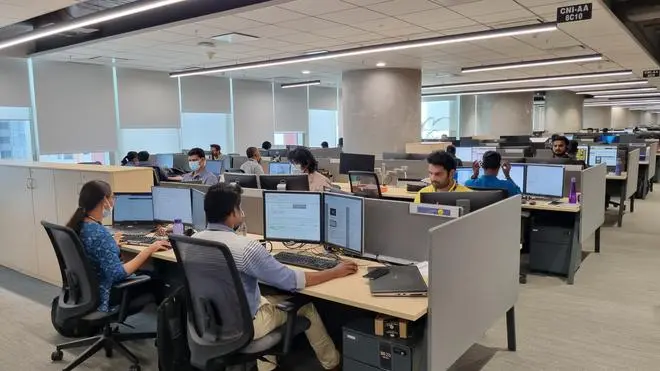

A view of Caterpillar Global engineering services’ software lab

Take global mining and construction equipment major, Caterpillar’s Global Engineering Services in Chennai. With 3,500 engineers it is the largest engineering footprint for Caterpillar outside of the US. Bansi Phansalkar, VP, Global Engineering & Country Leader, Caterpillar India, says the Chennai centre’s autonomy and automation product group provides remote control and software for Caterpillar machines. Its electronic virtual proving ground, for construction and mining machines, in a single system integration ecosystem comprises 28 product lines, 110 models and 3D simulators and uses 3D objects and environments allowing engineers to quickly refine software ahead of the real-world tests.

Machine behaviour

“What we do here is that before the entire electronics and control systems get on to our machines or even multiple machines which talk to each other, all of that can be designed and proven without actually having the machine. The behaviour of the machine is put on a simulator but all the electronics are alive and we put it through a number of tests to make sure that we cover everything that requires to be covered for safety,” explains Phansalkar.

Bansi Phansalkar, VP, Global Engineering & Country Leader, Caterpillar India

Phansalkar points out that perhaps 15 years ago cost arbitrage for an MNC was a big thing. “But we have gone past that; we now lead the company in many areas. In terms of the value that we bring, cost is no longer a discussion. Chennai is a mini-Caterpillar for us. We can see the entire company, have access to all the company’s information and a big advantage of this is that people can cross pollinate, exchange tech, talent and solutions. So, that’s a huge advantage for a centre like Chennai which is now quite mature,” he elaborates.

A senior TN State government official says there is a lot of saturation in other States so MNCs are looking at geographic diversification. “And, of course, there is a lot of talent here and attrition is low; at least 10 per cent lower than other places and that makes a lot of difference. And, a manufacturing ecosystem also helps as GCCs cannot operate in a vacuum,” he says.

ANSR’s Ahuja says Chennai offers a large pool of top talent especially in emerging technologies such as digital, AI/cognitive, cloud, RPA/automation, info security; relatively low attrition rate, and lower cost of living has positioned the city top on the radar of global companies looking to set up their capability centres in India. Software, automotive and industrial verticals account for almost 50 per cent of the GCCs in the State while fintech is an emerging sector that the State is strongly promoting. “TN’s attractive blend of government-led policies, enabling infrastructure, emerging start-up ecosystem, favourable investment and development schemes and efficient connectivity to major North American and European destinations have created a fertile soil for GCCs,” he elaborates.

In 2022, more than 10 global companies have either set up new tech centres or expanded existing ones in Chennai. They include Amazon, PayPal, Zoom, Kapitus, NielsenIQ and BNY Mellon. “These companies say they have already found more than 50 per cent of their talent requirements which is a nod to Chennai’s talent availability,” adds Ahuja.

State R&D policy

While GCCs have been seeing explosive growth in Tamil Nadu, the State, however, has not evolved a separate policy for GCCs; instead, it is subsumed in the State’s R&D policy.

As per the policy document, “TN has around 150 GCCs with different industrial domains such as Ford, Caterpillar, Daimler, Renault Nissan, World Bank, Shell, PayPal, Verizon, AstraZeneca, Walmart, Bosch, Philips, Citi, Mr. Cooper. In TN, a manufacturing hub, the R&D ecosystem is driven by the industry. Many of the GCCs located in Tamil Nadu also have a manufacturing presence in the State. Hence, R&D centres and GCCs are highly interlinked in Tamil Nadu…As R&D centres focusing on Industry 4.0 meet GCCs in the third unbundling of globalisation, with the capability of delivering high technology at cost effective wages (as compared to the parent MNC headquarters), the prospects of high-value jobs for Tamil Nadu are manifold…Given that more than half the GCCs are engineering R&D firms, and TN is an established industrial hub, the State shall focus on R&D firms and GCCs to achieve higher value creation in output and employment.”

As ANSR’s Ahuja points out, the GCC revenues are expected to scale up to $60-$85 billion by 2025, adding another 10-15 lakh jobs nationally. “Chennai has a 10 per cent market share with the potential to be nearly 12-15 per cent in the next five years,” he adds. Chennai and TN have a substantial calling card to present now.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.