At restaurants, movie theatres, and even office pantries, we now routinely pay by scanning a QR code. Thousands of Indians have adopted this payment system over the past few years. But in recent weeks a change has crept in while making these payments. We don’t mind waiting a few seconds to find out what’s the cashback earned on the payment or the ‘reward’ awaiting us in the scratch card we ‘earned’ for the mobile payment.

There’s nothing new about these rewards, of course. During 2014–19, cashbacks were driving the popularity of the unified payments interface or UPI. The pandemic outbreak in 2020 accelerated the adoption of UPI, as it was no longer seen as an add-on payment option but the most preferred amid the lockdowns and other restrictions introduced to contain the spread of Covid-19; cashbacks and scratch cards became redundant for a while.

But now again, UPI players are dusting off these incentives as they attempt to expand their market reach.

Take Navi, for instance, which is said to have rapidly climbed up the ranks of UPI players. For every UPI transaction, Navi users get coins (10 coins equal one rupee) in a fixed rewards system similar to credit cards. The number of coins gained depends on luck and varies for each transaction. There are also rewards for referrals that lead to app downloads and purchase of digital gold or the opening of a mutual fund account.

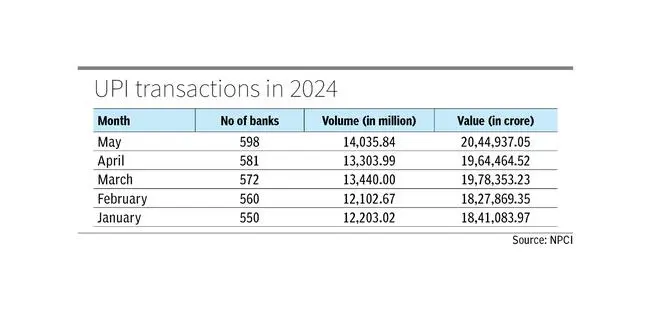

Navi’s UPI payments have grown 10 times in the last two months, helped by its cashback rewards. It clocked nearly 30 million UPI transactions in May, compared to 3 million in March and 15 million in April.

The spike in transactions propelled Navi to 11th position among the top UPI apps in May, from 27th in March. Minus the bank apps, Navi is in seventh position.

Taking a cue from Navi, recent entrants including Cred, Slice, Fampay, Zomato, Groww and Flipkart are laying out cashbacks to acquire new users and induce them to adopt their in-house UPI service.

Cred is seeing a steady rise in UPI payments, almost doubling its volume share from 0.5 per cent last April to 1 per cent in the first three months of 2024. In terms of value, the company’s market share has inched up from 1.5 per cent to 2.3 per cent this year.

On the other hand, Paytm, which has re-strategised to return to the old cashback route to rejuvenate its UPI business, is yet to see much success.

Payment apps enjoy a reasonable recall and stickiness from customers. Therefore, while Navi and Cred have seen initial success, the question is whether their handouts can move the needle on their UPI market share and fetch long-awaited profitability.

Experts say both outcomes are very unlikely.

Low on gains

The removal of merchant discount rates or MDR on UPI transactions since January 1, 2020, has changed the dynamics of these transactions. This is a segment where higher volumes can drive profits. But, unfortunately, the UPI payments space is largely split between PhonePe and GooglePay, which control 70 per cent of the market between them. Scratch cards offered by them are lucrative enough to compete with the cashbacks offered by the smaller players. With transactions alone not yielding the anticipated gains, why would the industry lure customers once again to use their UPI app?

The user base matters, say experts.

Attracting volumes

Like with any industry, the QR swipes may just be a starting point for more in store beyond payment. A newly emerging use case, which is proving to be somewhat attractive, is the linking of RuPay credit cards to UPI apps; this option is not available for Mastercard and Visa credit cards yet.

“Linking credit cards to UPI opens up the possibility of earning rewards on transactions, compared to debit cards/savings accounts, as the latter typically lacks rewards programmes,” says Mohit Bedi, Co-founder, Kiwi, a fintech startup.

The bigger piece of the pie is the customer data. Data, in recent years, is the new oil, especially for a country like India with a large population. The emerging thinking is that digital payments are no longer just about money transfers and, instead, hold a much bigger potential where the data exhaust of the transaction is more valuable than the transaction itself; given the exponential rise in digital payments, this is eventually helping reduce the cost of transactions.

“Traditional digital payment companies charge merchants a small fee, called merchant discount rate, to ensure a transaction is carried out. With the proliferation of UPI, which reduces the cost of transaction to almost zero, it’s a lucrative bet for the entire ecosystem,” says a senior executive of a Bengaluru-based firm.

“If one looks closely at the ecosystem, it’s clear that companies aren’t just providing ease of payments but also a platform for users to explore other financial products,” says a private equity investor, who declined to be named.

But as a new monetisation model, namely data mining, seems to have emerged for UPI players, the question is whether it will find acceptance among investors. “Data-related gains, or payments being a feeder to another business is logical and can be revenue generative. But if payments should come down to that extent, a PE investor may prefer an e-commerce company over a payments outfit,” says the CEO of a B2B payments company.

The newer entrants may need another 12–18 months to demonstrate their success and financials to the investor community.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.